Direct investment is a crucial aspect of global economic interactions, facilitating capital flow between countries and fostering economic development. However, like any economic activity, it has its drawbacks. In this article, we will explore the main disadvantage of direct investment and its implications.

To Direct Investment

What is the main disadvantage of direct investment, Direct investment, a pivotal aspect of global economics, involves allocating resources into ventures outside one’s home country, aiming to establish a lasting interest and significant influence.

It’s a strategic move made by corporations to expand their market reach, gain access to new markets, and capitalize on emerging opportunities. While direct investment holds promise for economic growth and innovation, it also bears inherent risks.

One primary disadvantage lies in the dependency on foreign investors, which can render economies susceptible to external shocks and fluctuations. Additionally, excessive reliance on direct investment may result in a loss of control over domestic resources and industries.

Despite these challenges, effective regulation and strategic planning can help mitigate risks and maximize the benefits of direct investment. Overall, understanding the complexities and potential drawbacks of direct investment is crucial for nations seeking to navigate the intricacies of the global economy.

Definition of Direct Investment

Direct investment refers to the acquisition of a substantial stake or controlling interest in a business enterprise or asset located in a foreign country. This form of investment involves a long-term commitment and active involvement in the management and operations of the invested entity.

Unlike portfolio investment, which involves the purchase of stocks or bonds with no managerial control, direct investment allows investors to exert influence over strategic decisions and corporate governance.

Direct investment can take various forms, including mergers, acquisitions, joint ventures, and greenfield investments. The primary objective of direct investment is to establish a durable presence in a foreign market, capitalize on growth opportunities, and leverage synergies for mutual benefit.

It plays a crucial role in fostering economic development, facilitating technology transfer, and promoting international trade and integration. As a result, direct investment is a vital driver of global economic growth and prosperity.

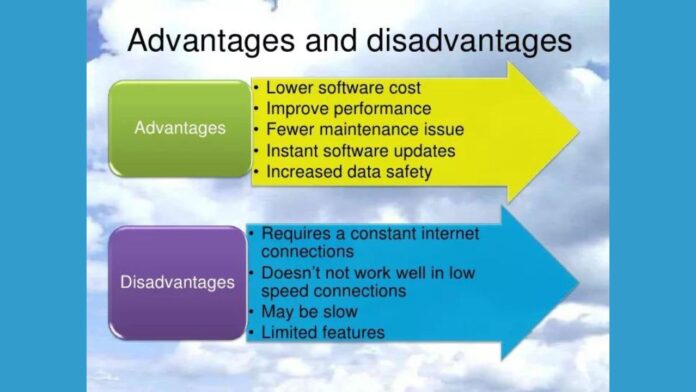

Advantages of Direct Investment

Direct investment offers numerous advantages that contribute to economic growth and development. Firstly, it stimulates job creation by injecting capital into local economies, thereby reducing unemployment rates and improving living standards.

Additionally, direct investment facilitates the transfer of technology and expertise from multinational corporations to host countries, fostering innovation and enhancing productivity.

Furthermore, direct investment promotes infrastructure development and upgrades, laying the foundation for sustained economic expansion. By attracting foreign capital, countries can access new markets, diversify their revenue streams, and reduce reliance on domestic resources.

Moreover, direct investment often leads to increased competition and efficiency within industries, driving down prices for consumers and spurring entrepreneurial activity. Overall, the advantages of direct investment extend beyond financial gains, contributing to social progress, technological advancement, and global integration.

As countries continue to embrace foreign investment, they unlock new opportunities for growth and prosperity on both local and international scales.

Main Disadvantage of Direct Investment

What is the main disadvantage of direct investment, Despite its advantages, direct investment entails inherent risks and challenges, the most significant of which is the dependency on foreign investors.

When a country relies heavily on external capital for its economic activities, it becomes vulnerable to fluctuations in global markets and changes in investor sentiment.

Furthermore, direct investment may result in a loss of control over domestic resources and strategic industries.

Multinational corporations wielding substantial influence may prioritize profit maximization over local interests, leading to disparities in wealth distribution and resource allocation.

Impact on Local Businesses

The impact of various factors on local businesses is profound and multifaceted. External forces such as economic policies, market trends, and technological advancements significantly influence the operational landscape of small and medium enterprises (SMEs).

Changes in consumer behavior, competitive dynamics, and regulatory frameworks can directly affect the profitability and sustainability of local businesses.

Moreover, the influx of foreign investment and the expansion of multinational corporations can pose both opportunities and challenges for indigenous enterprises.

While increased competition may spur innovation and efficiency, it can also exert pressure on smaller players, potentially leading to market consolidation and reduced diversity.

Furthermore, local businesses must navigate through challenges such as access to financing, talent acquisition, and compliance with regulatory requirements. Strategic adaptation and resilience are essential for SMEs to thrive amidst changing market dynamics and emerge as key contributors to economic growth and community development.

Case Studies Illustrating Disadvantages

What is the main disadvantage of direct investment, Case studies vividly illustrate the potential disadvantages of direct investment, offering real-life examples of its impact on economies and communities.

For instance, in Argentina during the early 2000s, extensive direct investment led to a significant economic downturn when foreign investors withdrew capital amidst a financial crisis, causing widespread unemployment and social unrest.

Similarly, in Southeast Asia, countries like Thailand and Indonesia experienced adverse effects from overreliance on foreign investment during the Asian financial crisis of 1997. The sudden withdrawal of foreign capital resulted in currency devaluation, economic contraction, and financial instability, highlighting the risks associated with dependency on external funding.

These case studies underscore the vulnerability of economies to fluctuations in global markets and the potential repercussions of excessive reliance on direct investment.

They serve as cautionary tales for policymakers and investors, emphasizing the importance of diversification and prudent economic management to mitigate risks and safeguard national interests.

Strategies for Mitigating Disadvantages

Mitigating the disadvantages associated with any endeavor is crucial for sustainable progress. In the context of direct investment, several strategies can be employed to alleviate its negative impacts:

- Implementing robust regulatory frameworks helps to ensure that foreign investment aligns with national interests and societal welfare.

- Diversifying the economy reduces dependency on a single sector or source of funding, thereby enhancing resilience to economic shocks. Encouraging domestic entrepreneurship and innovation fosters a competitive environment and reduces reliance on foreign enterprises.

- Promoting transparency and accountability in business transactions enhances investor confidence and mitigates the risk of exploitation.

- Fostering partnerships between government, private sector, and civil society enables collaborative problem-solving and ensures inclusive development.

By adopting these strategies, countries can effectively manage the challenges associated with direct investment and maximize its benefits for sustainable growth and development.

What are the Disadvantages of Foreign Direct Investment

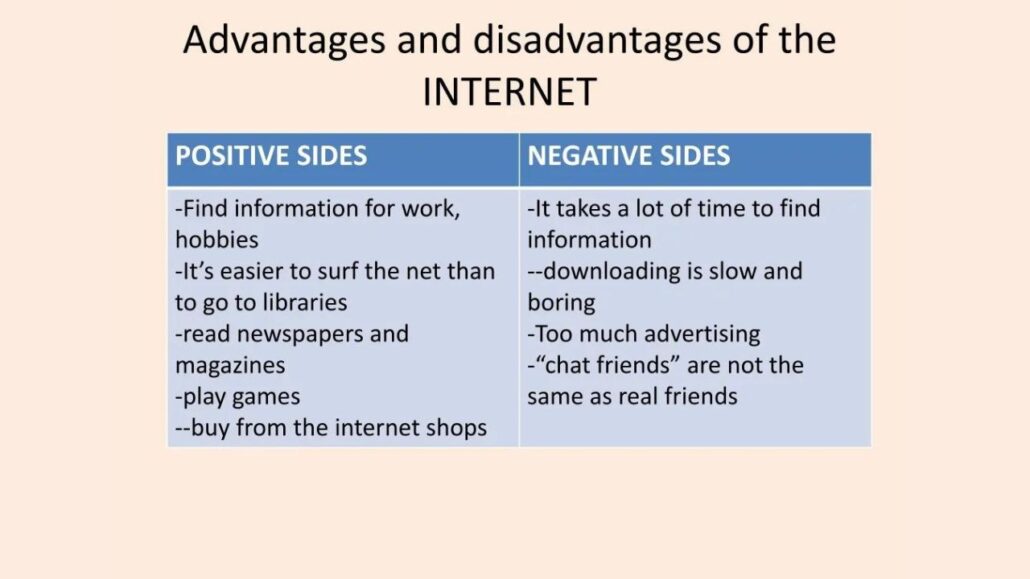

What is the main disadvantage of direct investment, Foreign direct investment (FDI) undoubtedly brings benefits, but it also carries several disadvantages:

- FDI can lead to a loss of domestic control over key industries and resources. When foreign entities acquire significant stakes, decision-making power may shift away from local authorities.

- FDI can create dependency on foreign investors, making economies vulnerable to external shocks and fluctuations.

- There’s a risk of exploitation, where multinational corporations prioritize profit over local interests, potentially leading to labor abuses and environmental degradation.

- FDI may exacerbate income inequality by favoring sectors with higher profit margins, neglecting smaller businesses and rural communities.

- Repatriation of profits can drain the host country’s wealth as dividends and royalties flow back to foreign investors’ home countries.

While FDI can stimulate economic growth, policymakers must carefully consider its implications to ensure sustainable development and safeguard national interests.

What is the Meaning of Foreign Direct Investment

Foreign Direct Investment (FDI) refers to the investment made by a company or individual in one country into business interests located in another country. In simpler terms, it involves the establishment of business operations or the acquisition of business assets in a foreign country.

The main purpose of foreign direct investment is to gain a significant level of control or influence over the management and operations of the foreign enterprise.

FDI plays a crucial role in the global economy by facilitating the flow of capital, technology, and expertise across borders.

It allows companies to expand their market presence, access new resources, and tap into emerging opportunities in foreign markets. Additionally, FDI contributes to economic growth, job creation, and knowledge transfer in host countries.

Overall, foreign direct investment serves as a vehicle for promoting international trade, fostering economic development, and enhancing global integration.

What is the Advantage of Foreign Direct Investment?

Foreign direct investment (FDI) offers numerous advantages to both host countries and investing entities. One significant advantage is the infusion of capital into the host country’s economy, which stimulates economic growth and development.

FDI also facilitates the transfer of technology, knowledge, and managerial expertise, thereby enhancing productivity and competitiveness in local industries.

Additionally, foreign investors often bring with them access to global markets, opening up new opportunities for local businesses to expand and thrive internationally. FDI can create employment opportunities, improve infrastructure, and foster innovation through research and development initiatives.

Furthermore, by diversifying the sources of investment, countries can reduce their dependence on domestic savings and mitigate risks associated with economic fluctuations. Overall, foreign direct investment catalyzes sustainable development and plays a vital role in promoting global economic integration and cooperation.

Conclusion

While direct investment catalyzes economic growth and development, its overreliance can expose countries to vulnerabilities and undermine local autonomy. By understanding the main disadvantages and implementing strategic interventions, nations can harness the benefits of foreign investment while safeguarding their sovereignty and economic resilience.

FAQ

What are the Advantages and Disadvantages of FDI?

Foreign direct investment can benefit host nations greatly by fostering economic expansion, creating new jobs, and transferring knowledge. It also presents difficulties, such as the possibility of losing power, rivalry for resources, and susceptibility to global economic trends.

What are the Advantages and Disadvantages of Horizontal Foreign Direct Investment?

Horizontal FDI can stimulate economic growth in the domestic economy by creating jobs, enhancing technological capabilities and fostering competition. It may also have potential negative impacts, such as crowding out domestic firms or increasing income inequality.

Is FDI a Good Thing?

FDI can foster and maintain economic growth in both the recipient country and the country investing. On the one hand, developing countries have encouraged FDI as a means of financing the construction of new infrastructure and the creation of jobs for their local workers.

Which of the Following is an Advantage of Direct Investment?

Direct investors wish to refrain from taking direct investors’ aim to avoid actions that could diminish the value or long-term viability of their investments. Inward direct investment brings about several favorable outcomes, such as heightened employment opportunities, enhanced productivity levels, the transfer of technology and knowledge, and overall economic expansion.

What is the Safest Type of Investment?

The concept of the “safest investment” can vary depending on individual perspectives and economic contexts. Still, generally, cash and government bonds, particularly U.S. Treasury securities, are often considered among the safest investment options available. This is because there is minimal risk of loss.