A bake-off in investment banking is a competitive process where multiple banks vie for a client’s deal or advisory mandate. Through presentations and proposals, banks showcase their expertise and strategies to secure lucrative opportunities, emphasizing relationships, capabilities, and successful execution.

To Investment Banking

Investment banking stands as a cornerstone of the financial industry, facilitating vital functions such as underwriting, mergers and acquisitions, and corporate advisory services. Its primary role involves connecting entities in need of capital with investors willing to provide it.

Investment banks serve as intermediaries, facilitating complex transactions and providing strategic guidance to corporations, governments, and other entities navigating the intricacies of capital markets.

With expertise in financial analysis, risk management, and market dynamics, investment banks play a pivotal role in shaping the global economy. Their services range from raising capital through public offerings to facilitating large-scale mergers and acquisitions.

Investment banking operates within a dynamic landscape characterized by regulatory scrutiny, technological innovation, and market volatility.

As such, investment bankers must possess keen analytical skills, strategic foresight, and a deep understanding of financial instruments and market trends to navigate challenges and capitalize on opportunities in today’s ever-evolving financial ecosystem.

The Concept of a “Bake Off”

The concept of a “Bake Off” in various industries, including investment banking, involves a competitive process where multiple participants vie for a specific opportunity. In investment banking, a bake-off typically occurs when several banks compete to secure a lucrative deal or advisory mandate from a client.

Each bank presents its credentials, expertise, and proposed strategies to win the client’s confidence. The bake-off process usually includes invitation, presentation, and evaluation stages, wherein banks demonstrate their capabilities and suitability for the task at hand.

Clients evaluate proposals based on various criteria such as experience, track record, pricing, and alignment with their objectives before making a decision.

The significance of bake-offs lies in their ability to foster competition, drive innovation, and ultimately benefit clients by ensuring they receive the best possible service and solutions tailored to their needs.

Importance of Bake Offs in Investment Banking

The importance of bake-offs in investment banking cannot be overstated. These competitive processes serve as pivotal platforms for banks to showcase their expertise, forge relationships with clients, and secure lucrative deals.

By participating in bake-offs, banks demonstrate their capabilities, innovative solutions, and commitment to client success, thus enhancing their visibility and reputation within the industry.

Furthermore, bake-offs enable banks to tailor their proposals to meet the specific needs and objectives of clients, fostering trust and confidence in their ability to deliver results. In today’s dynamic financial landscape,

where competition is fierce, and clients demand excellence, bake-offs offer invaluable opportunities for investment banks to differentiate themselves, win new business, and sustain long-term growth.

As such, investment banks must recognize the significance of bake-offs and invest resources strategically to maximize their chances of success in securing coveted deals and mandates.

Establishing Relationships

A bake-off in investment banking is a competitive process where multiple banks vie for a client’s deal or advisory mandate. Through presentations and proposals, banks showcase their expertise and strategies to secure lucrative opportunities, emphasizing relationships, capabilities, and successful execution.

Establishing relationships is a crucial aspect of both personal and professional life. In business, it’s especially vital, particularly in industries like investment banking. Building strong relationships with clients fosters trust, loyalty, and mutual understanding.

Establishing relationships goes beyond mere transactions. It involves deepening connections through effective communication, empathy, and delivering value-added services. By understanding clients’ needs, preferences, and long-term goals, investment bankers can tailor their solutions and recommendations accordingly.

Successful relationship-building in investment banking requires sincerity, integrity, and a commitment to client satisfaction. It’s about going the extra mile to anticipate and address clients’ concerns, offering personalized solutions, and consistently delivering exceptional service.

Demonstrating Capabilities

Demonstrating capabilities in the context of investment banking bake-offs is paramount for securing lucrative deals and advisory mandates. Investment banks must showcase their expertise, track record, and innovative solutions to stand out among competitors.

This involves highlighting industry knowledge, financial acumen, and successful transaction execution. By effectively communicating their strengths and value proposition, banks instill confidence in clients, positioning themselves as trusted partners in complex financial transactions.

Demonstrating capabilities goes beyond mere presentation—it’s about illustrating a deep understanding of client needs, industry dynamics, and regulatory considerations. Banks that excel in demonstrating their capabilities not only win business but also foster long-term relationships built on trust and reliability.

Competitive investment banking landscape, the ability to showcase capabilities is a cornerstone of success, driving growth and reputation in the dynamic world of finance.

How Bake Offs Work in Practice

Bake-offs in investment banking follow a structured process. It begins with client invitations to select banks, who then submit proposals outlining qualifications and strategies.

Shortlisted banks present their proposals to the client, addressing deal structures, valuation methods, and risk management. Clients evaluate proposals based on expertise, reputation, and alignment with objectives. Ultimately, a winning bank is chosen to proceed with the deal or advisory mandate.

This process fosters competition, encouraging banks to demonstrate their capabilities and innovative solutions. It also allows clients to assess various options and select the most suitable partner for their financial needs. Bake-offs serve as a platform for meaningful dialogue between banks and clients, facilitating collaboration and trust-building.

Through effective presentation and strategic alignment, banks can leverage bake-offs to secure lucrative opportunities and solidify their position in the competitive landscape of investment banking.

Invitation and Selection Process

The invitation and selection process in a bake-off is a pivotal stage where investment banks vie for lucrative deals. Clients issue invitations to select banks, who then submit proposals showcasing their expertise and strategies.

The client evaluates these proposals based on criteria like experience, reputation, and alignment with objectives. Shortlisted banks are invited to present their proposals, engaging in detailed discussions with the client’s decision-makers.

This phase is critical as it allows banks to demonstrate their capabilities and understanding of the client’s needs. Presentations often involve outlining deal structures, valuation methodologies, and risk management strategies.

The client carefully assesses each presentation before making a decision. For investment banks, navigating this process requires thorough preparation, effective communication, and differentiation from competitors.

Success in the invitation and selection process not only secures business but also establishes long-term relationships with clients, underscoring the importance of this initial phase in the competitive landscape of investment banking.

Presentation and Proposal

The presentation and proposal stage is pivotal. Shortlisted banks present their strategies, credentials, and fee structures to the client’s decision-makers. This phase demands clear articulation of deal structures, valuation methodologies, risk management strategies, and regulatory considerations.

Effective communication and persuasive presentation skills are essential to convey the bank’s value proposition convincingly. The presentation serves as a platform to showcase expertise, demonstrate understanding of client needs, and differentiate from competitors. Detailed proposals outline the bank’s tailored approach, highlighting past successes and innovative solutions.

Client engagement and responsiveness during this phase can significantly influence decision-making. Banks must address potential concerns and objections proactively, fostering confidence and trust.

Successful presentations can lead to fruitful partnerships and lucrative deals, underscoring the importance of meticulous preparation and compelling delivery in the competitive landscape of investment banking.

Evaluation and Decision-Making

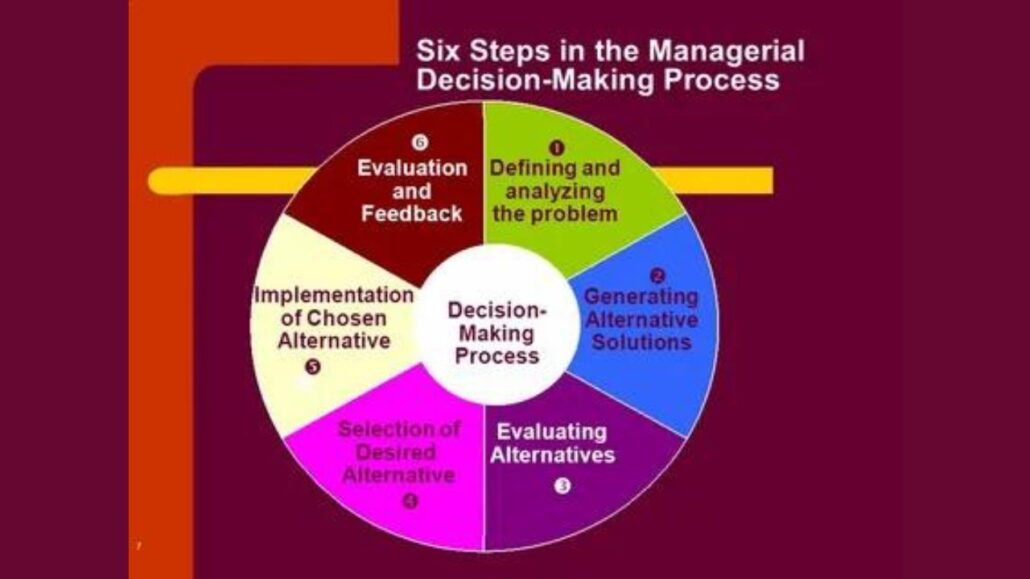

Evaluation and decision-making are pivotal stages in the bake-off process of investment banking. Clients meticulously assess proposals based on expertise, reputation, pricing, and alignment with objectives.

The decision hinges on the bank’s ability to address risks effectively and provide innovative solutions, ultimately determining the winner and shaping future collaborations. This phase requires thorough analysis and consideration of each bank’s capabilities and strategies.

Factors like past performance, industry knowledge, and the quality of proposed solutions profoundly influence the client’s decision. Effective communication and clarity in presenting the proposed strategy play a crucial role in swaying the client’s evaluation positively.

The decision-making process signifies not only the selection of a banking partner but also the initiation of a collaborative journey towards achieving the client’s financial objectives. It underscores the significance of strategic alignment, trust, and mutual understanding between the client and the chosen investment bank.

Advantages of Participating in a Bake-Off

Participating in a bake-off offers several advantages for investment banks, including:

- Visibility and Exposure: Bake-offs provide exposure to high-profile deals and clients, enhancing the bank’s visibility within the industry.

- Opportunity for Growth: Winning a bake-off can lead to lucrative financial transactions, bolstering the bank’s revenue streams and market position.

- Enhanced Reputation: Successful participation in bake-offs reinforces the bank’s reputation for excellence and reliability, attracting future clients and opportunities.

Risks Associated with Bake Offs

While bake-offs offer significant opportunities, they also pose certain and risks:

- Intense Competition: The competitive nature of bake-offs demands extensive preparation and resource allocation, often leading to heightened pressure and stress among participating banks.

- Resource Drain: Investing significant time and resources in multiple bake-offs without securing deals can strain the bank’s finances and human capital.

- Reputational Risk: Failure to perform adequately in a bake-off can tarnish the bank’s reputation and erode client confidence, affecting future business prospects.

Strategies for Success in a Bake-Off

To navigate the complexities of a bake-off successfully, investment banks can adopt the following strategies:

- Thorough Preparation: Conduct comprehensive research on the client’s industry, competitors, and specific needs to tailor the proposal effectively.

- Differentiation: Highlight unique selling points, innovative solutions, and past successes to differentiate the bank from competitors.

- Effective Communication: Articulate the proposed strategy and value proposition clearly and concisely during presentations, addressing potential concerns and objections proactively.

Real-life Examples of Bake Offs in Investment Banking

Real-life examples of bake-offs in investment banking illustrate the competitive nature and strategic significance of these events. In one instance, multiple investment banks vied for a high-profile merger and acquisition deal involving a leading technology company.

Another example involves the restructuring of a distressed financial institution during the global financial crisis. These bake-offs required banks to demonstrate their expertise in areas such as mergers and acquisitions, strategic planning, and regulatory compliance.

The intensity of competition in these scenarios underscores the importance of thorough preparation, effective communication, and differentiation strategies. Ultimately, the winning bank secures not only the deal or advisory mandate but also enhances its reputation and market position.

These real-life examples serve as compelling reminders of the pivotal role bake-offs play in shaping the competitive landscape of investment banking, driving innovation, and fostering strategic partnerships for financial institutions.

Conclusion

Bake-offs play a pivotal role in the competitive landscape of investment banking, offering a platform for banks to showcase their capabilities, forge relationships, and secure lucrative deals. Understanding the dynamics and nuances of bake-offs is essential for investment banks seeking to thrive in today’s dynamic financial markets.

FAQ

What does Bake Off Mean in Business?

A “Beauty Contest” or “Bake-Off” in investment banking refers to the process where prospective clients interview multiple investment banks to select a financial advisor, underwriter, or placement agent for a potential transaction. It serves as a method for clients to evaluate and choose the most suitable banking partner for their needs.

What is the Bake-off Process for an IPO?

Before selecting underwriters and more formally beginning the IPO process, companies typically hold what is referred to as a “bake-off,” during which they meet and interview underwriting candidates, and banks usually provide presentations explaining why they are best suited to take the company public and outlining to

Why is it Called a Bake-Off?

PBS reported that the Pillsbury Company, which has held the Pillsbury Bake-Off contest since 1949, owns the registered trademark for the term “Bake-Off.” In order to avoid any confusion among viewers, the company opted not to release the rights to the term, prompting the need for a new title.

What are Bake-off Products?

Bake-off products are prepared frozen bakery products that are kept in the freezer and can be baked anytime. The bake-off first appeared in the 1980s as a solution for quick access to freshly baked bread, allowing customers to have fresh and crispy mini baguettes at home for dinner.

What is the IPO Process in Bangladesh?

The IPO approval process starts with the submission of an application to the Bangladesh Securities and Exchange (BSEC). To help the company issuing the common stock (known as the issuing firm), the issuing firm appoints an issue manager from the list approved by BSEC.