Starting Your Own Investment Fundasset can be rewarding and satisfying in the present powerful economic climate. In any case, leaving on this excursion requires a profound comprehension of the complexities in question. This guide will walk you through the basics of starting Your Own Investment Fund venture reserve effectively, whether you are an experienced investor who wants to deal with an asset or a novice who is wondering what the potential outcomes might be. Now, We should dig into the universe of venture reserves.

What is an Investment Fund?

An investment fund is a pooled capital vehicle where a professional fund manager collectively manages investors’ money. These funds come in various types, including mutual, hedge, and private equity funds. Each type serves different purposes and targets specific types of investors.

Types of Investment Funds

- Mutual Funds: These are open-end funds that pool money from multiple investors to invest in stocks, bonds, or other securities.

- Hedge Funds: Hedge funds are typically open to accredited investors and employ various strategies to generate returns, including long and short positions.

- Private Equity Funds: These funds invest in private companies, often to acquire or restructure them.

- Venture Capital Funds: Venture capital funds specialize in early-stage investments in startups and high-growth companies.

Legal and Regulatory Framework

Establishing the Fund Structure

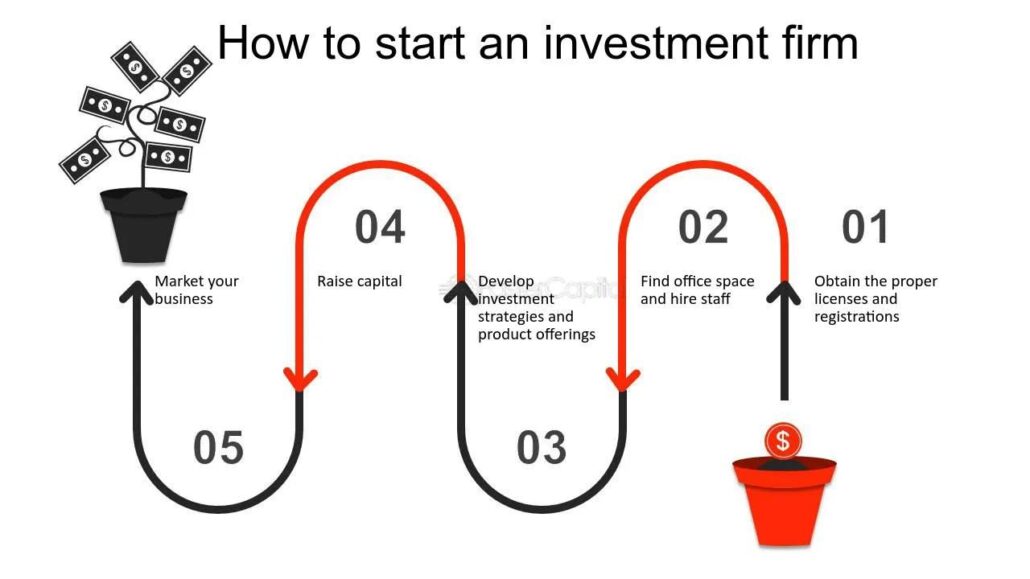

The first step in starting Your Own Investment fund is to choose a legal structure. Common options include limited partnerships, limited liability companies (LLCs), or trusts. Talk with legitimate specialists to determine which design suits your targets and consents to nearby guidelines.

Regulatory Compliance

Compliance with financial regulations is paramount. Be aware of the specific laws governing Starting Your Own Investment Fund in your jurisdiction, such as the Securities Act in the United States. Counsel legitimate direction to guarantee you meet every administrative necessity.

Building a Solid Investment Strategy

Define Your Investment Focus

Distinguish your asset’s Starting Your Own Investment Fund targets and methodologies. Is it true or not that you are keen on values, fixed pay, land, or elective resources? Your procedure should line up with your ability and market open doors.

Research and Market Analysis

Direct careful statistical surveying to distinguish patterns, dangers, and likely open doors. Use research instruments and information investigation to illuminate your speculation choices.

Fundraising and Attracting Investors

Creating an Offering Document

Set up an exhaustive contribution record that frames your asset’s venture procedure, dangers, and possible returns. This archive is pivotal for drawing in financial backers.

Networking and Marketing

Construct an organization of expected financial backers and accomplices. Go to industry occasions, utilize web-based entertainment, and influence your expert organization to get the news about your asset.

Portfolio Management and Diversification

Effective Portfolio Management

Once your fund is operational, focus on effective portfolio management. Diversify your investments to spread risk and optimize returns.

Active Monitoring

Constantly monitor your portfolio’s performance and adjust your strategy as needed. Staying informed about market developments is key to success.

Risk Management Strategies

Risk Assessment

Identify and assess the risks associated with Starting Your Own Investment Fund. Identify potential losses and develop strategies to mitigate them.

Hedge Against Market Volatility

Consider employing hedging techniques to protect your portfolio from market downturns.

Reporting and Compliance

Investor Reporting

Regularly provide detailed reports to your investors, outlining fund performance, fees, and any changes to the investment strategy.

Compliance Audits

Engage an auditor to ensure your fund complies with all regulatory requirements.

Fundraising and Attracting Investors

Due Diligence

Investors will conduct due diligence before committing capital to your fund. Be prepared to provide detailed information about your fund’s strategy, past performance (if any), and your team’s qualifications.

Investment Pitches

Make convincing venture pitches and introductions. Impart your asset’s exceptional selling focuses, execution potential, and chance administration systems.

Transparency and Trust

Build trust with potential investors by emphasizing transparency in your dealings. Be honest about potential risks and ensure investors are well-informed.

Portfolio Management and Diversification

Asset Allocation

Determine your portfolio’s ideal mix of assets based on your investment strategy. Depending on your fund’s focus, this may include stocks, bonds, real estate, or other assets.

Rebalancing

Regularly review and rebalance your portfolio to maintain the desired asset allocation. This ensures your investments align with your fund’s objectives.

Risk Management Strategies

Portfolio Insurance

Consider using choices and protection items to safeguard your portfolio from critical misfortunes. These can go about as shields during market slumps.

Stress Testing

Reproduce different market situations to comprehend how your portfolio could perform under antagonistic circumstances. This can assist with recognizing weaknesses and further developing risks for the executives.

Reporting and Compliance

Investor Relations

Maintain open lines of communication with your investors. Address their inquiries promptly and provide regular updates on fund performance.

Regulatory Changes

Stay vigilant about changes in financial regulations that may impact your fund. Adapt your compliance practices accordingly.

Scaling Your Investment Fund

Asset Growth

As your asset gets forward momentum and draws in additional financial backers, dealing with the expanded resources becomes vital. Carry out versatile frameworks and cycles to oblige development while keeping up with execution guidelines.

Team Expansion

Consider extending your group to deal with the developing liabilities related to a bigger asset. This might incorporate employing extra examiners, consistency officials, and regulatory staff.

Performance Evaluation

Benchmarking

Consistently contrast your asset’s exhibition with significant benchmarks. This permits you to check how well your ventures are doing contrasted with more extensive market records.

Performance Attribution

Dissect the elements adding to your asset’s exhibition. Is it because of your venture choices, resource portion, or economic situations? Understanding these variables can assist with refining your system.

Marketing and Investor Relations

Brand Building

Put resources into building areas of strength for your asset. A deep-rooted brand can draw in additional financial backers and put you aside in a cutthroat market.

Investor Feedback

Look for criticism from your financial backers to grasp their necessities and inclinations. Tailor your correspondence and administrations appropriately to upgrade their experience.

Staying Adaptable

Market Dynamics

Perceive that monetary business sectors are continually developing. Be ready to adjust your speculation system to jump all over new chances and explore difficulties.

Regulatory Changes

Stay vigilant about regulatory changes that could impact your fund. Compliance is crucial to maintaining investor trust and avoiding legal issues.

The Importance of Networking

Industry Events

Keep going to industry occasions and meetings to connect with expected financial backers, accomplices, and individual asset supervisors. Building major areas of strength for an organization can open ways to important open doors.

Collaborations

Investigate coordinated effort valuable open doors with other speculation experts or firms. Joint endeavors and associations can grow your scope and aptitude.

Navigating Economic Downturns

Risk Mitigation

Having a distinct gamble moderation methodology is fundamental during financial slumps or market emergencies. Think about diminishing openness to unstable resources and expanding cash property.

Investor Communication

Straightforward and clear correspondence with financial backers during difficult stretches is significant. Address their interests and make sense of your procedure for enduring the hardship.

Achieving Long-Term Success

Patience and Discipline

Successful fund management requires patience and discipline. You should avoid making impulsive investment decisions based on short-term market fluctuations. Stick to your long-term strategy.

Consistent Communication

Keep up with steady correspondence with your financial backers. Customary updates, bulletins, and execution reports can assist with building trust and keep your financial backers informed.

Leveraging Technology

Fintech Solutions

Explore fintech solutions and investment software to streamline your fund’s operations. These devices can help with portfolios, the board, detailing, and information investigation.

Cybersecurity

Put resources into powerful network safety measures to safeguard your assets and financial backers from potential digital dangers. Information breaks can have extreme outcomes in the monetary business.

Exit Strategies

Liquidity Planning

Consider your fund’s exit strategy. How will you provide liquidity to investors when they want to redeem their shares? Having a reasonable arrangement set up is fundamental.

Succession Planning

Plan for the future of your fund, including succession. What happens if you are no longer able to manage the fund? Identifying potential successors is crucial.

Continuous Learning and Improvement

Professional Development

Put resources into your proficient turn of events. Remain refreshed with recent venture patterns, attend courses, and acquire applicable certificates to improve your abilities.

Performance Review

Periodically review your fund’s performance and assess whether your investment strategy aligns with your objectives. Be willing to adapt and improve.

Adhering to Ethical Standards

Ethical Considerations

Maintain high ethical standards in your fund management. Integrity and ethical behavior are essential for building and preserving trust with investors.

ESG Investing

Consider environmental, social, and governance (ESG) factors in your investment decisions. Many investors are increasingly interested in socially responsible investing.

Expanding Your Horizons

Global Opportunities

Explore global investment opportunities beyond your local market. Diversifying into international markets can offer new prospects for growth.

Alternative Investments

Remain open to elective venture choices, like digital currencies, land, or confidential value. These can add expansion to your portfolio.

Navigating Market Volatility

Market Cycles

Understand that financial markets go through cycles of expansion and contraction. Being prepared for market volatility is key to managing your fund effectively.

Asset Allocation

During volatile periods, consider adjusting your asset allocation to reduce risk. Allocating more to defensive assets like bonds can provide stability.

Building a Robust Team

Talent Acquisition

Invest in recruiting and retaining top talent as your fund grows. A skilled and dedicated team is invaluable for making informed investment decisions. As your asset develops, put resources into enrolling and holding top ability. A gifted and committed group is important for pursuing informed venture choices.

Delegation

Learn the art of delegation before Starting Your Own Investment Fund. Trust your team to handle specific aspects of fund management, allowing you to focus on strategic decisions.

Monitoring Regulatory Changes

Regulatory Compliance

Remain cautious about changes in monetary guidelines. Rebelliousness can prompt lawful difficulties and harm your asset’s standing.

Tax Efficiency

Work with charge experts to improve your asset’s assessment productivity. Proficient duty arranging can upgrade returns for your financial backers.

Crisis Management

Contingency Plans

Prepare contingency plans for unexpected crises, whether economic downturns or unforeseen events. Having a clear plan can mitigate potential damage.

Investor Relations

Maintain open communication with your investors during crises. Transparency and reassurance help retain their confidence.

Diversifying Investment Strategies

Multi-Strategy Approach

Consider implementing a multi-strategy approach to diversify your fund’s investments. This can help navigate various market conditions.

Quantitative Strategies

Explore quantitative investment strategies that use mathematical models and algorithms to make data-driven decisions.

Staying Informed

Financial News

Stay up-to-date with financial news and global events that can impact the markets. Ideal data is urgent for going with informed choices.

Economic Indicators

Screen monetary pointers, for example, Gross domestic product development, expansion rates, and loan costs. These pointers give experiences into more extensive financial patterns.

Engaging with the Investment Community

Peer Discussions

Engage with fellow fund managers and investors through industry forums and conferences. Sharing insights and experiences can be enlightening.

Thought Leadership

Establish yourself as a thought leader in the investment community by publishing research, giving talks, or contributing to industry publications.

Nurturing Investor Relationships

Long-Term Partnerships

View your investors as long-term partners in your journey. Building strong relationships can lead to repeat investments and referrals.

Your Impact on the Market

Responsible Investing

Consider the impact your fund has on the market and society. Responsible and sustainable investing can generate positive outcomes.

Conclusion

Beginning and dealing with a Starting Your Own Investment Fund venture reserve is significant, yet it can offer critical prizes. As you leave this excursion, recollect that achievement frequently requires nonstop learning and transformation.

Stay Informed

Monetary business sectors advance, and remaining informed about industry patterns, arising innovations, and financial improvements is vital. Go to gatherings, read research reports, and draw in with specialists in the field to keep your insight ebb and flow.

Seek Mentorship

Think about looking for mentorship or working with experienced venture business experts. Their direction can assist you with exploring difficulties and settling on informed choices.

Never Stop Improving

Think about looking for mentorship or working with experienced venture business experts. Their direction can assist you with exploring difficulties and settling on informed choices.

FAQ

How much capital do I need to start an investment fund?

The capital required varies depending on your fund’s strategy and objectives. The amount can range from a few hundred thousand dollars to millions.

Do I need prior experience to start an investment fund?

While prior experience in finance is beneficial, it is only sometimes a prerequisite. Partnering with experienced professionals can compensate for limited experience.

Can I start an investment fund as an individual?

Indeed, you can; however, having a group to deal with different viewpoints, like legitimate consistency, portfolio the board, and financial backer relations, is fitting.

What is the typical fee structure for investment funds?

Investment funds often charge management fees (usually a percentage of assets under management) and performance fees (a percentage of profits). These percentages can vary widely.

How can I differentiate my fund from competitors?

Differentiation can come from your investment strategy, track record, transparency, or unique value proposition. Highlight what sets your fund apart.