Gain a competitive edge in Investment Banking by mastering Excel Skills for Investment Banking. Learn essential spreadsheet techniques, financial modeling, and data analysis to excel in this dynamic financial sector.

Excel’s versatility allows professionals in investment banking to streamline tasks, make informed decisions, and present complex financial information effectively. This comprehensive guide will delve into the Excel skills necessary for success in investment banking, providing you with a roadmap to excel(l) in your finance career.

The Basics

The Excel Interface

To start your Excel journey, familiarize yourself with the interface. Learn about the Ribbon, Quick Access Toolbar, cells, columns, rows, and worksheets. Excel’s interface is your canvas; mastering it will help you navigate the software efficiently.

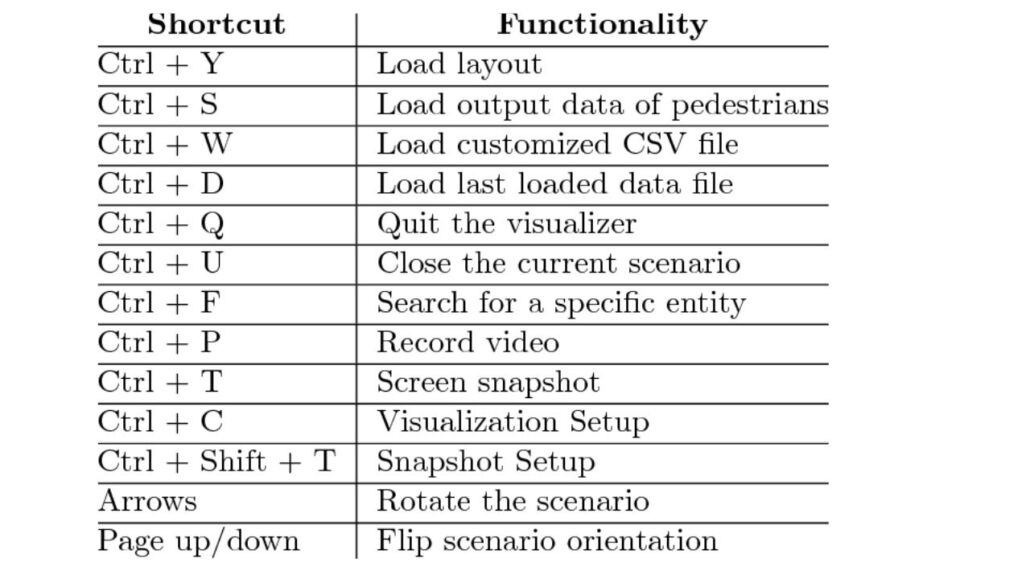

Essential Keyboard Shortcuts

Efficiency is key in investment banking, and keyboard shortcuts are your secret weapon. Learn the basics like Ctrl+C (copy), Ctrl+V (paste), Ctrl+S (save), and Ctrl+Z (undo). More sophisticated shortcuts, such as Ctrl+Home, Ctrl+Page Up/Page Down, and Ctrl+Arrow keys, can greatly enhance your navigational abilities…

Data Entry and Formatting

Investment banking often involves working with large datasets. To maintain your spreadsheets’ organization and aesthetic appeal, master the art of data entry and formatting. Cell formatting, number formats, and data validation.

Formulas and Functions

Excel Functions for Investment Banking

Master commonly used functions like SUM, AVERAGE, MIN, MAX, IF, and VLOOKUP. These operations are the foundation for financial modeling, enabling you to conduct computations and come to informed conclusions.

Creating Formulas

Learn how to write and structure formulas effectively. Operator precedence, cell references (relative, absolute, and mixed), and formula auditing tools to troubleshoot errors.

Financial Functions

Explore Excel’s financial functions, such as NPV, IRR, PMT, and FV. These functions are indispensable for valuation, cash flow analysis, and risk assessment.

Data Analysis and Visualization

Sorting and Filtering

Efficiently manage data by sorting and filtering. Master AutoFilter, Sort, and Advanced Filter for organizing and analyzing data sets.

PivotTables

Excel skills for investment banking datasets. Please become familiar with creating PivotTables, customizing them, and using PivotCharts to depict data visually.

Data Validation

Ensure data accuracy by setting up data validation rules. This is crucial when dealing with financial models where incorrect inputs can lead to significant errors.

Conditional Formatting

Make your spreadsheets visually intuitive by using conditional formatting. Highlight important data points, trends, or outliers with ease.

Excel Techniques

Macros and VBA

Automate repetitive tasks by creating macros using Visual Basic for Applications (VBA). This advanced skill can save you hours of work and improve accuracy.

Advanced-Data Analysis

Dive into advanced data analysis techniques using tools like Goal Seek, Solver, and Scenario Manager. When dealing with intricate financial models and decision-making, these are helpful.

Power Query and Power Pivot

Explore the capabilities of Excel’s Power Query and Power Pivot features. With the aid of these tools, you may efficiently work with enormous datasets and carry out intricate data transformations.

Financial Modelling

Building Financial Models

Learn the art of building financial models from scratch. Recognize the essential elements, including the income statements, balance sheets, and cash flow statements. Excel’s formulaic structure is ideal for modeling complex financial scenarios.

Sensitivity Analysis

Master sensitivity analysis to assess the impact of changing variables on financial models. Tools like Data Tables and Scenario Manager help you make informed decisions in uncertain environments.

Valuation Models

Learn about two complex valuation techniques: relative value and discounted cash flow (DCF) analysis. Excel’s financial functions are instrumental in these processes.

Data Presentation

Charts and Graphs

Learn to produce visually appealing graphs and charts. To present your data effectively. Scatter plots, bar charts, and line charts are a few of the chart kinds that Excel offers.

Data Tables

Use data tables to perform sensitivity analysis and present multiple scenarios in an organized manner.

Collaboration and Data Sharing

Data Sharing and Import/Export

Master data sharing techniques by importing and exporting data between Excel and other software applications. This skill is crucial for collaboration and information exchange.

Collaboration Features

Explore collaboration features like Excel Online, sharing workbooks, and tracking changes. These tools facilitate teamwork and enhance productivity.

Best Practices

Workbook Organization

Implement best practices for workbook organization, including naming conventions, sheet structure, and documentation. Well-organized workbooks are easier to navigate and

Error Handling

To in sure that your financial models and analysis are accurate, develop your error-checking and error-handling skills.

Version Control

Use version control techniques to monitor changes. And revisions in complex financial models.

Essential Excel Skills for Beginners:

With this in-depth guide, explore the world of Microsoft Excel.

Learn the fundamental skills and techniques to navigate spreadsheets, input data, create basic formulas, and format your worksheets like a pro. Whether you’re a student, a professional, or just trying to sharpen your Excel skills, this area is your starting point for mastering Excel.

Advanced Excel Skills:

Take your Excel expertise to the next level with our advanced skills section.

Discover the secrets of data analysis, pivot tables, complex formulas, and automation.

To simplify work, analyze data effectively, and become a true Excel master, learn to use Excel’s advanced capabilities.

Unlock the full potential of this versatile program and enhance your professional toolkit.

Get the Most out of Excel:

Excel is more than just a spreadsheet program; it’s a productivity powerhouse. To help you get the most out of Excel’s features, this section looks into hints, shortcuts, and other helpful information. From customizing your interface to using keyboard shortcuts, organizing your workbooks efficiently, and collaborating with others seamlessly, we’ll show you how to maximize your Excel experience.

Conclusion

Mastering Excel skills is a fundamental requirement for success in investment banking. Whether you’re building financial models, analyzing data, or presenting your findings, Excel’s capabilities are essential tools in your arsenal.

You’ll be well-equipped to succeed in the challenging and rewarding world of investment banking by following this comprehensive tutorial and continually improving your Excel abilities.

Remember, practice makes perfect, so start building those financial models and analyzing data today. Your future success in investment banking depends on it!

FAQ

Is Excel needed for investment banking?

Excel is indispensable for financial modeling, data analysis, and reporting in investment banking.

Which Excel course is best for investment banking?

Courses like “Excel for Finance” or “Financial Modeling with Excel” are popular choices. Look for courses that cover financial functions and modeling techniques.

What skills do investment bankers need?

Investment bankers need financial modeling, valuation, data analysis, communication, and negotiation skills.

What can Excel be used for in finance?

Excel in finance is used for financial modeling, budgeting, data analysis, creating charts, and managing financial data efficiently.

Why is Excel important in banking?

The capacity of Excel to execute complex calculations, analyze financial data, construct models, and generate reports—all of which are necessary for decision-making and financial analysis—makes it a crucial tool in the banking industry.