Lay out money on renewable energy stocks can be a wise financial settlement, as it provides the potential for financial gain and supports sustainable initiatives. One such company that has been gaining attention in the renewable energy sector is Vortex Energy. In this guide, we’ll take you through the step-by-step how to buy vortex energy stock, equipping you with the wisdom to make informed investment decisions.

Investing in renewable energy stocks like Vortex Energy is a sound financial decision and a socially responsible one. Companies like Vortex Energy are at the forefront of the renewable energy sector, providing sustainable solutions to combat climate change.

Investing in renewable energy has become increasingly popular as investors seek to align their financial objectives with environmental stewardship. Investing in companies like Vortex Energy can support the shift towards cleaner energy sources while potentially generating long-term financial returns. As the world continues prioritising sustainability and combat climate change, renewable energy stocks will likely remain an attractive investment opportunity for socially responsible investors.

Step-by-Step Guide on How to Buy Vortex Energy Stock

What is Vortex Energy?

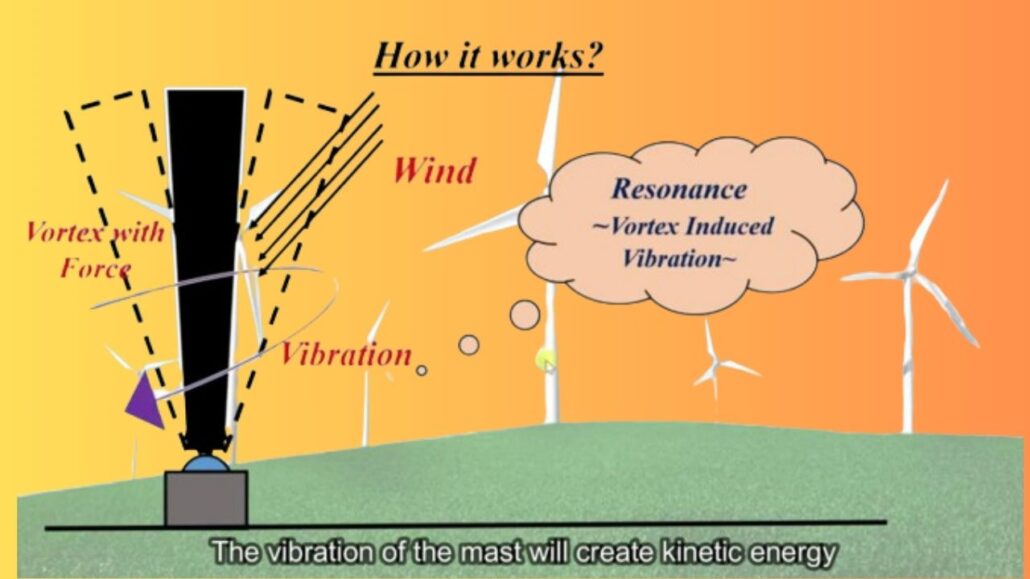

Vortex Energy is a leading player in the renewable energy sector, specialized in developing and operating wind and solar power projects across various regions. The company has a global presence is committed to providing sustainable solutions to help combat climate change. Investing in Vortex Energy aligns with both financial objectives and environmental stewardship.

Why Vortex Energy Stock?

Investing in Vortex Energy aligns with both financial objectives and environmental stewardship. Vortex Energy stock offers investors the opportunity to take part in the growth of the renewable energy sector. As governments worldwide enact policies to reduce carbon emissions and promote clean energy initiatives, companies like Vortex Energy benefit from increased demand for renewable power solutions.

Market Analysis

Before purchasing Vortex Energy stock, it is important to conduct thorough market analysis to realize the company’s financial performance, growth prospects, and competitive positioning within the renewable energy sector to finalise our topics how to buy vortex energy stock. Analyze key mark such as revenue growth, profit margins, and market share to gauge the company’s potential for success. It is also important to stay current on any news or events that may impact Vortex Energy’s stock price.

Company Performance

Evaluate Vortex Energy’s project development track record, revenue growth, and profitability. Assess the company’s pipeline of projects and its ability to execute future initiatives. Understanding the fundamentals of Vortex Energy will help you make informed investment decisions.

Choosing a Brokerage

To buy Vortex Energy stock, you’ll need to open an account with a creditable brokerage platform that offers access to the stock market. Look for platforms that provide comprehensive research tools, competitive commission rates, and user-friendly interfaces to streamline the investment process. Some popular brokerage platforms include Robinhood, E-Trade, and TD Ameritrade. Research different brokerage options and consider factors such as trading fees, account minimums, and available investment tools.

Fund Your Account

After creating your account, you must fund it with sufficient capital to purchase Vortex Energy stock. Most brokerage platforms offer multiple funding options, such as bank transfers, wire transfers, or electronic funds transfers (EFTs). Select the option best suits your preferences and transfer the amount you wished for to your brokerage account. It is important to note that some brokerage platforms may require a minimum deposit amount. Once your account is set up, you can start buying Vortex Energy stock.

Dollar-Cost Averaging

Consider employing a dollar-cost averaging strategy, where you invest a fixed amount of money in Vortex Energy stock at regular intervals, regardless of price fluctuations. This approach can help smooth out volatility and lower your average cost per share over time.

Timing the Market

Alternatively, you can time your purchases based on market conditions and Vortex Energy’s stock price movements. Monitor macroeconomic factors, industry news, and technical analysis indicators to identify favourable entry points.

Place an Order

Once your account is funded, please navigate to the trading platform and search for Vortex Energy stock using its ticker symbol. The ticker symbol for Vortex Energy is “VTX”. Define the number of shares you wish to purchase and the order type (e.g., market order, limit order). Assesment the order details carefully before submitting it to ensure accuracy. It is also important to consider any trading fees or commissions the brokerage platform charges.

Tips for Successful Investing

Diversify Your Portfolio

While investing in Vortex Energy stock can be profitable, it’s essential to diversify your portfolio to mitigate risk. Allocate your investment capital across multiple asset classes, industries, and geographic regions to minimize the impact of market fluctuations on your overall portfolio. This can also help to reduce the impact of any potential losses.

Stay Informed

Keep updated on industry trends, regulatory developments, and company-specific news that may impact Vortex Energy stock. Utilize financial news outlets, analyst reports, and corporate filings to stay informed and make well-informed investment decisions. It is also important to stay current on any changes in government policies or regulations related to renewable energy.

Adopt a Long-Term Perspective

Adopt a Long-Term Perspective Adopt a long-term perspective when investing in Vortex Energy stock, focusing on the company’s growth potential and sustainability over time. Avoid succumbing to short-term market fluctuations or attempting to time the market, as this can lead to impulsive decision-making and suboptimal results. Concede holding onto your investment for several years to reap the benefits of long-term growth potentially.

Potential Risks and Challenges

Market Volatility

Like any investment, Vortex Energy stock is subject to market volatility, which can lead to fluctuations in its price and valuation. Be prepared for short-term price swings and focus on the company’s underlying fundamentals rather than reacting to temporary market noise. It is important to be prepared for short-term fluctuations and have a long-term prospect when investing in Vortex Energy stock.

Regulatory Changes

Changes in government policies, regulations, or subsidies related to renewable energy can impact Vortex Energy’s operations and financial performance. Stay abreast of regulatory developments and evaluate their potential implications for the company’s future growth prospects. This can also help identify potential risks or challenges associated with investing in Vortex Energy stock.

Industry Trends

The renewable energy sector is dynamic and rapidly evolving. Stay informed about industry trends, technological advancements, and regulatory developments that could affect Vortex Energy’s business operations and growth prospects.

Monitoring Your Investment

Regularly monitor the performance of your Vortex Energy stock investment. Use your brokerage’s financial tools and resources to track the stock’s price movements, dividends, and overall portfolio performance.

Adjusting Your Strategy

Be flexible in adapting your investment strategy as needed. Reassess your investment thesis for Vortex Energy based on new information and changes in market conditions. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Conclusion

Investing in Vortex Energy stock can provide both financial and environmental benefits. By following the step-by-step guide discussed above how to buy vortex energy stock and practising the tips for successful investing, you can make informed investment decisions and potentially reap the rewards of supporting sustainable initiatives.

It is important to conduct thorough research and stay current on any news or events that may impact Vortex Energy’s stock price. By understanding the company’s fundamentals, conducting thorough research, and implementing a disciplined investment strategy, you can position yourself for long-term success in the market.

FAQs

What is Vortex Energy?

Vortex Energy is a leading player in the renewable energy sector, specializing in developing and operating wind and solar power projects across various regions. The company is committed to providing sustainable solutions to help combat climate change.

What are the potential risks of investing in Vortex Energy stock?

Like any investment, Vortex Energy stock is subject to market volatility and regulatory changes. Be prepared for short-term price swings and stay informed on any changes in government policies and regulations related to renewable energy. It is also important to consider any potential risks or challenges associated with investing in Vortex Energy stock.

Why invest in renewable energy?

Investing in renewable energy aligns with both financial objectives and environmental stewardship. Renewable energy sources offer long-term sustainability and resilience compared to fossil fuels, making them attractive investment opportunities for those seeking stable returns while contributing to a greener planet.

Is Vortex Energy a good investment?

As with any investment, conducting thorough research and assessing your risk tolerance before investing in Vortex Energy stock is essential.