Electric vehicles (EVs) have revolutionized the automotive industry, with companies like Eli Electric Vehicles leading the charge towards sustainable transportation solutions. If you’re considering investing in Eli Electric Vehicles stock or just curious about its performance, this article Eli Electric Vehicles stock price will provide a comprehensive overview.

Let’s start with a quick rundown of what Eli Electric Vehicles is all about and why understanding its stock price matters. Eli Electric Vehicles is a pioneering company in the electric vehicle (EV) industry, known for its innovative designs and commitment to sustainable transportation solutions. As with any publicly traded company, keeping an eye on its stock price can provide valuable insights into its performance, market sentiment, and potential investment opportunities.

Company Background: Eli Electric Vehicles Stock Price

Before we delve into the intricacies of its stock price, let’s take a moment to familiarise ourselves with the backstory of Eli Electric Vehicles. ELI Electric Vehicles originated in Silicon Valley, the birthplace of many technological breakthroughs.

The company’s founders, passionate about clean energy and mobility, envisioned a future where electric vehicles dominate the roads. Founded in 2010, Eli Electric Vehicles has quickly risen to prominence in the EV market thanks to its cutting-edge technology and forward-thinking approach.

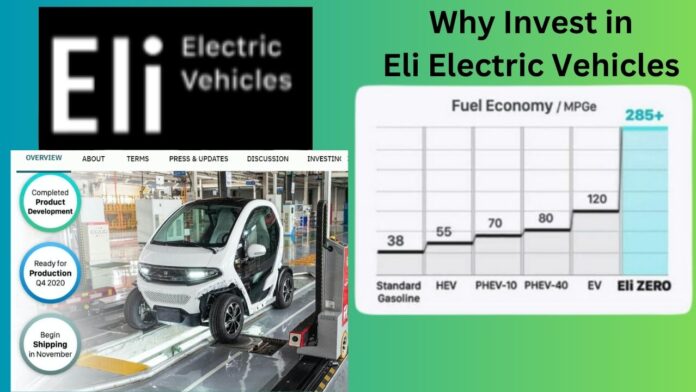

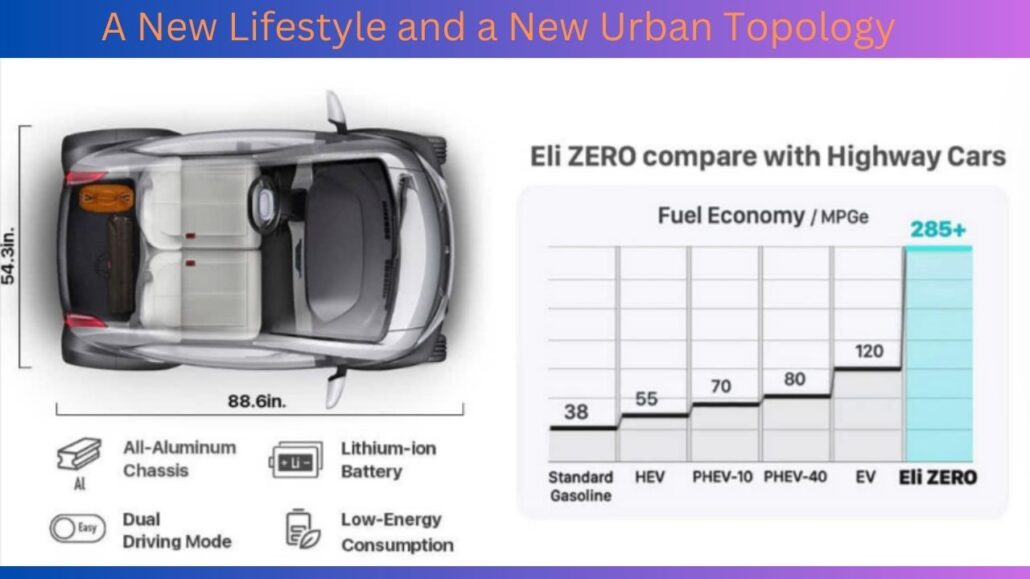

The company’s flagship products, including the Eli Zero and Eli Ryder, garnered praise for their eco-friendly design and impressive performance.

Mission and Vision

ELI’s mission is clear: accelerating the world’s transition to sustainable transportation. By producing high-quality electric vehicles accessible to all, ELI strives to reduce reliance on fossil fuels and combat climate change.

ELI Electric Vehicles Stock Overview

ELI’s stock performance is of keen interest to investors and industry analysts. Let’s delve into the factors influencing its stock price dynamics.

Recent Performance

Now that we’ve laid the groundwork let’s look at recent developments influencing Eli Electric Vehicles’ stock price. ELI’s stock has experienced significant fluctuations in recent months, mirroring broader market trends and industry developments. Understanding these fluctuations requires a closer look at both internal and external factors.

Factors Affecting Stock Price

What exactly influences the price of Eli Electric Vehicles stock? Several factors can impact ELI’s stock price, including company earnings reports, technological advancements, regulatory changes, and market sentiment towards the EV sector.

Industry Trends: Eli Electric Vehicles Stock Price

The electric vehicle industry is still in its nascent stage, with new players entering the market every day. Competition is fierce, and market sentiment can be highly volatile. Keeping concern on industry trends and innovations can help investors anticipate potential market shifts and stay ahead of the curve.

The EV market is constantly evolving, with technological advancements, regulatory changes, and shifting consumer preferences shaping its trajectory. As a key player in this space, Eli Electric Vehicles’ stock price is intricately tied to broader industry trends.

Monitoring developments such as government incentives for EV adoption, advancements in battery technology, and emerging competitors can furnish valuable insights into the company’s prospects. To gauge ELI’s prospects, analysing prevailing market trends and industry dynamics is essential.

Financial Performance

Of course, a company’s financial performance is one of the most significant drivers of stock price movement. Investors closely scrutinise revenue growth, profit margins, and cash flow metrics to gauge Eli Electric Vehicles’ financial health and growth potential.

A strong financial stability and profitability track record can bolster investor confidence and drive stock price appreciation. A deep dive into ELI’s financial performance provides valuable insights for investors evaluating the company’s long-term viability.

News and Public Perception

In today’s digital age, news travels fast, and public perception can profoundly impact stock prices. Positive press coverage, product announcements, or partnerships can send Eli Electric Vehicles’ stock soaring, while negative publicity or controversies may trigger sell-offs. Staying abreast of the latest news and monitoring social media sentiment can furnish valuable insights into market sentiment and potential stock price movements.

Recent Developments

Eli Electric Vehicles has made headlines in recent months thanks to several key developments, including the launch of its Eli Zero model in Europe and a strategic partnership with a leading battery supplier. Keeping a close eye on these developments and their impact on the market can furnish valuable insights for investors.

Impact on Stock Price:

The fallout from these events has been reflected in Eli Electric Vehicles’ stock price, with sharp spikes and dips mirroring market sentiment and investor reactions. Understanding the underlying factors driving these movements is crucial for navigating the volatile world of stock trading.

Technical Analysis

For the more technically inclined investors, let’s look at Eli Electric Vehicles’ stock price trends and key technical indicators.

Stock Price Trends

Analysing Eli Electric Vehicles’ historical stock price data can reveal patterns and trends that may offer valuable insights for investors. Whether identifying support and resistance levels or spotting potential breakout opportunities, technical analysis can help investors make informed decisions based on market dynamics.

Support and Resistance Levels

Support and resistance levels are crucial in determining Eli Electric Vehicles’ stock price movements. These levels represent points where buying and selling pressure converge, often serving as key decision points for traders. Identifying these levels can help investors anticipate potential price reversals and reconcil their trading strategies accordingly.

Fundamental Analysis

In addition to technical analysis, fundamental factors are crucial in determining Eli Electric Vehicles’ stock price.

Key Financial Metrics

Delving into Eli Electric Vehicles’ financial statements can provide insights into its value and growth prospects. Key financial metrics like as earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio can help investors assess the company’s financial health and valuation relative to its peers.

Competitor Comparison

Comparing Eli Electric Vehicles’ performance against its competitors can shed light on its relative strengths and weaknesses. Investors can use this information to make careful decisions about potential investment opportunities.

Conclusion

Eli Electric Vehicles is a company with a bright future in the EV market. Understanding its stock price dynamics requires a deep dive into both internal and external factors, including industry trends, financial performance, news and public perception, and recent developments.

By keeping a close eye on these factors and using both technical and fundamental analysis, investors can make informed decisions about investing in Eli Electric Vehicles stock.

FAQ

Is investing in Eli Electric Vehicles stock a good idea?

As with any investment, there is no guarantee of success. However, Eli Electric Vehicles has shown promising growth potential in the EV market, and keeping a close eye on industry trends and financial metrics can help investors make informed decisions.

What key factors affect Eli Electric Vehicles’ stock price?

Key factors include industry trends, financial performance, news and public perception, and recent developments such as product launches and strategic partnerships.

What is technical data, and how can it help investors?

Technical analysis involves analysing historical stock price data to identify model and trends that can offer valuable insights for investors. This information can help investors make careful decisions about potential investment opportunities.