“Car insurance as a racket” suggests that some view the auto insurance industry negatively, claiming it’s designed to exploit consumers.

Critics argue that insurers prioritize profits over customers, offering confusing policies with excessive premiums and complicated terms. They highlight overcharging, low file-a-claim payout, and unethical practices.

However, proponents argue insurance is necessary for protection, and reform is needed to ensure fairness and transparency in the industry.

What Is Car Insurance?

Before we can answer whether or much a car insurance policy is a racket, it’s essential to grasp the fundamental concept of car insurance policy work itself.

Car Insurance Defined

An agreement for auto insurance is made between a person (the policyholder) and an insurance provider. The insurance provider offers financial protection in the event of auto-related car accidents, theft, or damage in return for recurring premium payments.

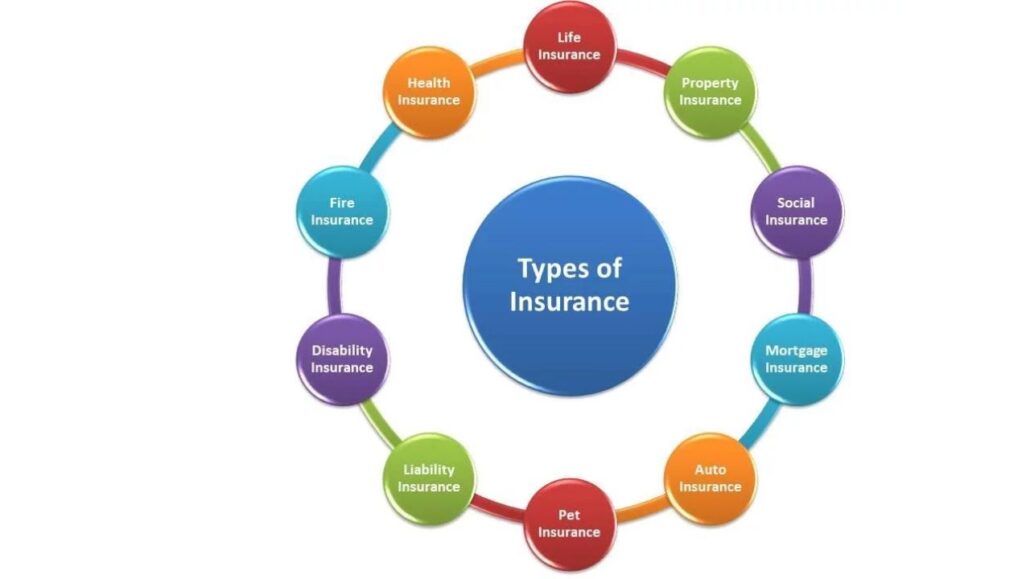

Types of Car Insurance Policies

Various car gap insurance policies are available, each offering distinct medical payment coverage. Some of the most common ones include:

Auto Insurance

This is the most fundamental auto insurance liability covering personal injury protection and property damage.

Car Insurance Policy

A comprehensive car insurance policy typically covers many incidents, including car accidents, theft, vandalism, and natural disasters.

Uninsured Motorist Coverage

This type of insurance safeguards you if you’re involved in a car accident with an uninsured or underinsured driver.

Personal Injury Protection (PIP)

No matter who was at fault for the collision, PIP types of car insurance work will pay for your and your passengers’ car accident-related medical payments, coverage bills and lost wages.

The Controversy Surrounding Car Insurance

Now that we have a basic understanding of auto insurance, let’s delve into its controversy.

The Cost of Car Insurance

One of the primary reasons people question the integrity of types of car insurance work is the cost associated with it. Premiums can be substantial, and policyholders often wonder if they are getting value for their money.

Claim Denials and Coverage Gaps

Another area of concern is the claim process. Some policyholders have experienced claim denials or uninsured motorist coverage gaps, leading to frustration and doubt about the insurance’s efficacy.

Complex Terminology and Fine Print

Auto insurance policies are often laden with complex jargon and fine print. This can make it challenging for policyholders to fully understand their medical payment coverage, leading to suspicions about hidden clauses.

Separating Fact from Fiction

Now, let’s address the question at the heart of this article: Is an auto insurance company a racket?

The Reality of Car Insurance

At its core, the car insurance company will pay is not a racket. It serves a crucial purpose by providing financial personal injury protection during accidents or unexpected events. However, personal injury protection is a legitimate concern that must be addressed.

The Role of Regulation

Strict regulations and oversight are in place to prevent any malpractices within the auto insurance coverage industry. Insurance companies must minimum limits adhere to these rules to maintain their legitimacy.

Making Informed Choices

As consumers, it’s essential to make informed choices when selecting a car insurance company policy. Reading the fine print, understanding the types of how much coverage limits, and doing so can help ensure you’re getting the finest deal possible.

Demystifying Car Insurance: How It Works and Who Is Covered

A car insurance policy is a fundamental aspect of responsible car ownership. It offers financial protection and peace of mind while on the road. However, understanding how car insurance coverage works and who is covered can sometimes feel like navigating a maze. This article will shed light on these aspects, addressing common keywords related to insurance coverage and policies.

Kinds of Car Insurance Coverage

Liability insurance, which typically consists of two key components, plays a critical role in covering costs resulting from accidents for which you are held legally responsible:

Bodily Injury Coverage: Takes care of expenses related to injuries or deaths suffered by others (such as another driver, their passengers, or a pedestrian) when you are at fault.

Property Damage Coverage: Handles expenses related to repairing or replacing other people’s property (such as fences or houses) that you damage while operating your vehicle.

Most states require drivers to have a minimum liability coverage before registering and operating a vehicle in that state. To determine the specific liability coverage required in your state, consult your state’s Department of Motor Vehicles (DMV) or our Auto Insurance by State guide.

Find out more about how auto liability insurance works.

Uninsured motorist coverage offers financial protection when you are injured in an accident and the other driver lacks auto insurance.

Depending on your location, this coverage may include property damage. Additionally, uninsured motorist coverage helps you if you are the victim of a hit-and-run incident. Some states may impose a minimum coverage requirement for uninsured drivers.

Consider also exploring underinsured motorist (UIM) coverage, which typically covers the difference between your expenses and the at-fault driver’s policy limit when your limits fall short. However, underinsured motorist coverage may only apply in certain states if your underinsured motorist limits exceed the other driver’s liability limits.

Learn more about uninsured motorist coverage.

Personal injury protection (PIP), a form of no-fault insurance, covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

PIP can also extend to incidents where you are cycling or walking and are hit by a vehicle. In some cases, PIP coverage can reimburse you for lost wages and expenses incurred by not being able to perform tasks such as house cleaning.

PIP is required in some states and optional in others. For information about PIP availability and requirements in your state, check with your state DMV.

Learn more about how PIP insurance works.

Medical payment coverage (MedPay) shares similarities with personal injury protection in that it covers medical bills for you and your passengers after a car accident, regardless of fault. However, unlike PIP, MedPay does not cover additional or related expenses, such as lost wages.

Collision coverage covers repair costs if your vehicle is damaged in a car accident or collides with another object, even if you are at fault. This coverage may also include protection against damage caused by potholes.

Learn more about the mechanics of auto collision insurance.

Comprehensive or non-collision coverage addresses damage to your vehicle resulting from events unrelated to car accidents or collisions with objects.

Covered losses cover scenarios such as fire damage, hail damage, falling object damage, cracked or shattered windshields, vandalism, animal damage, and even theft reimbursement.

The Driver, Not the Car

One crucial concept is that car insurance typically revolves around the driver, not the vehicle. When you purchase car insurance, you’re essentially insuring yourself as a driver, and this coverage extends to the cars you drive.

How Car Insurance Extends

In simple terms, if you have car insurance coverage and you’re driving someone else’s car with their permission, your insurance should generally cover you in the event of an accident or incident. This flexibility is one of the key benefits of car insurance.

Policy Limitations

However, it’s essential to recognize that the specifics of insurance policies can vary. Your policy may have certain limitations or conditions. For instance:

- Some policies may exclude coverage if you’re driving a car you own but didn’t list on your policy.

- Coverage might not apply if you drive a car without the owner’s permission.

Factors Influencing Insurance Rates

Insurance rates are not one-size-fits-all; they’re influenced by various factors, including the primary driver’s characteristics.

Primary Driver’s Characteristics

When determining rates, insurance companies consider the primary

driver’s age, driving history, and location. These details help insurers assess the level of risk associated with insuring a particular individual.

Impact on Coverage and Premiums

If someone other than the primary driver regularly operates the same vehicle but isn’t listed on the insurance policy, it could impact the coverage and the premiums. In some cases, adding them to the policy might be necessary to ensure adequate coverage.

Understanding Your Policy

To ensure you clearly understand how your car insurance coverage works and who is covered, it’s essential to evaluate your policy.

The Premium Predicament

One of the primary reasons people question the fairness of car insurance is the cost of premiums. Based on elements including your age, gender, location, and driving history, premiums might differ significantly.

Critics argue that this variability often leads to unjust pricing, where some individuals pay significantly more than others for similar coverage.

The Claims Conundrum

Regarding car insurance, one of the key aspects that often raises concerns is the claims process. Auto insurance companies promise to be there for you when you’re in need. Still, the reality of filing a claim can sometimes feel like navigating a labyrinth of complexities and frustrations.

In this article, we’ll delve into the intricacies of the claims process, discussing terms like “actual cash value,” property damage, covered claims, and more to shed light on what policyholders should know.

The Role of “Actual Cash Value”

When the unexpected happens, and your vehicle sustains damage in an accident, your auto insurance policy is meant to step in and provide the financial support you need. However, this is where the concept of “actual cash value” comes into play. Actual cash value (ACV) is the market value of your car today, taking into account things like depreciation.

The compensation may only partially cover the price of repairing or replacing the damaged car, which can occasionally make policyholders feel underpaid.

The Significance of Property Damage Coverage

Property damage is a critical aspect of car insurance claims. It encompasses the costs associated with Your car loan and any other property that needs maintenance or replacement that may have been damaged in the accident. Understanding the extent of property damage coverage your policy provides is crucial for ensuring you receive adequate compensation.

Deciphering “Covered Claims”

When faced with an accident or an unforeseen event, it’s essential to determine whether your claim falls under a “covered claim.” auto insurance policies can vary widely, and what is covered and to what extent can differ between policies.

Familiarizing yourself with the details of your insurance policy and its types of coverage is vital in understanding whether your specific situation qualifies for a claim.

The Role of the Insurance Information Institute

Auto Insurance is a valuable resource for policyholders seeking claim process guidance. They can provide insights into how to assess the extent of your coverage and understand how much collision coverage you need for your vehicle. Additionally, they offer information on what to expect when filing a claim, helping to demystify the process.

Family Members and Car Insurance

Regarding family members and the need for car insurance, clarifying who is covered under your policy is important. Depending on your policy’s terms, family members who drive your vehicle may or may not be automatically covered. A crucial factor to consider is ensuring that your loved ones are suitably safeguarded.

Knowing Your Rights

Filing a claim can indeed be a challenging experience. Policyholders often find that insurers may need more payouts, making it harder to receive the full benefits they’ve paid through their insurance premiums. This is where understanding your rights and the terms of your insurance policy is crucial.

State Minimum Coverage Requirements

Moreover, it’s essential to be aware of the minimum collision coverage required by your state’s laws, as this can impact your ability to recover linked costs, like missed pay resulting from injuries received during a car accident.

In conclusion, the claims process in car insurance can be complex and frustrating. However, by familiarizing yourself with the nuances of terms like “actual cash value,” property damage, and covered claims, and by seeking guidance from trusted resources like them, you can better navigate the path to securing the right car insurance and ensuring you receive the benefits you deserve.

The Profit Perspective

To understand whether an insurance agent is a racket, looking at the industry’s financial side is essential. Insurance companies are, after all, businesses aiming to make a profit.

The Underwriting Mystery

Insurers employ underwriters to assess risks and set premiums accordingly. Critics argue that these underwriters often use complicated algorithms prioritizing profit margins over fairness, resulting in higher premiums for some.

The Investment Game

Another aspect to consider is how insurance companies invest the premiums they collect. They invest in various assets to generate additional income. Critics suggest that these investments sometimes take precedence over serving policyholders’ best interests.

The Legal Landscape

Laws and regulations have a big impact on how car insurance is controlled. The system is further complicated because these rules might differ from state to state.

The Lobbying Influence

Critics claim that the insurance industry’s lobbying power affects regulations, potentially allowing companies to shape laws in their favour.

The Legal Battles

Car insurance works companies are no strangers to lawsuits. Some argue that they use their considerable resources to engage in legal battles against policyholders, making it challenging for individuals to seek justice.

The Alternative Approaches

We should explore alternative systems in some countries to determine whether car insurance is a racket.

No-Fault Insurance

Some regions have adopted a no-fault insurance system, where each driver’s mechanical breakdown insurance pays for their injuries and damages, regardless of fault. This approach aims to streamline the claims process and reduce legal disputes.

Public Insurance

In a few places, public insurance systems replace private insurers altogether. While this may simplify the process, it raises questions about government involvement and taxation.

The Car Insurance Industry: A Disgusting Racket

A car insurance claim has become an integral part of our lives in a world where car repair ownership is not just a convenience but often a necessity. However, a disturbing truth emerges as we delve deeper into car insurance is a racket. Many consumers feel that the need car insurance cover claim industry is, in fact, a disgusting racket. We will examine the causes of this mindset and highlight some troubling industry practices in this piece.

The High Premiums – A Heavy Burden

Skyrocketing Costs

One of the primary reasons for the negative perception of the rental car repair companies industry is the exorbitant premiums. Rental Car owners are burdened with ever-increasing costs, making it difficult to afford essential collision coverage.

Price Discrepancies

Consumers often find themselves bewildered by the vast price discrepancies between need auto insurance coverage providers. This lack of transparency raises questions about fairness and ethics within the industry.

The Claims Game

Delayed and Denied Claims

Claims are frequently denied or delayed by auto insurance carriers. Auto Policyholders encounter several obstacles when receiving their due compensation, which can cause frustration and mistrust.

Hidden Clauses

The fine print in insurance policies can be a minefield. Many auto policyholders discover hidden clauses that prevent them from making claims under certain circumstances, leaving them feeling cheated.

The Influence of Lobbying

Legislative Manipulation

The car insurance industry wields considerable influence in the political arena. Lobbying efforts have resulted in laws that protect insurance companies rather than consumers, further fueling the perception of a rigged system.

Lack of Accountability

Shifting Blame

Insurance companies often deflect blame onto policyholders, making them feel responsible for auto accidents even when they are not at fault. This practice erodes trust and fosters resentment.

Poor Customer Service

Customer service in the car insurance industry could be better. Many policyholders police report frustrating experiences when trying to get assistance or answers to their questions.

Conclusion

So, is car insurance a racket? The answer isn’t black and white. While the industry has flaws and complexities, it also provides essential financial protection for drivers. Researching and choosing insurance providers carefully is crucial, and advocating for fairer practices within the industry is crucial.

FAQ

Is Car Insurance a Legal Requirement?

Having personal auto insurance is often necessary to lawfully operate a vehicle on public highways.

How Can I Lower the Cost of My Vehicle Insurance?

You can reduce your premiums by keeping a clean driving record, raising your deductibles, and searching for the cheapest prices.

What is No-Fault Insurance, And How Does it Work?

No-fault insurance means that your insurance company covers your injury and damage expenses, regardless of who was at fault in an accident.

Are There Alternatives to Traditional Car Insurance?

Yes, alternatives like no-fault and public insurance exist in some regions, offering different approaches to collision coverage.

Should I Trust Online Insurance Comparison Websites?

Online comparison websites can be useful for finding competitive insurance rates, but verifying the information and reading reviews before deciding is essential.

This comprehensive article explored the car insurance company’s claim, addressing whether it’s a racket or a necessary financial safeguard. Remember that while the industry has drawbacks, it plays a vital role in protecting drivers from unexpected financial burdens.

What does car insurance mean?

Car insurance is financial protection for your vehicle against accidents, theft, and liability, often required by law.

What is auto insurance, and why do you need it?

Auto insurance is coverage for your car, necessary to protect you from financial losses in accidents and legal liabilities.