Investing in a small business offers the potential for significant returns, fosters local economic growth, and provides opportunities for community engagement. It allows investors to impact the business’s success directly and often involves lower entry costs than larger enterprises.

Investing in a small business can be a rewarding venture, offering many benefits beyond financial gains. Small businesses play a crucial role in fostering economic growth and innovation. This article explores the numerous advantages of investing in a small business, emphasizing the positive impact on investors and local communities.

Definition of Small Business

Small businesses are independently owned and operated enterprises characterized by their relatively small workforce and revenue. They form the backbone of many economies, contributing significantly to job creation and overall economic development.

Significance of Investing in Small Businesses

Investing in small businesses goes beyond financial gain; it is a commitment to supporting entrepreneurship and community development. The impact of such investments ripples through various aspects of the economy, creating a positive domino effect.

Benefits of Investing in a Small Business

Investing in small businesses can help to grow the economy and create jobs. In addition, small businesses are often more agile and adaptable than large businesses. They can more easily change their products and services to meet customer needs. They can also respond more quickly to new market opportunities.

Purchasing a small business has several advantages:

- High Growth Potential: Small businesses often have significant growth potential compared to larger, more established companies. With the right management and strategies, a small business can experience rapid growth, leading to substantial returns on investment.

- Direct Impact: Investing in a small business allows you to have a direct impact on its growth and success. Your capital infusion can enable the business to expand operations, develop new products or services, or enter new markets, directly contributing to its success.

- Potential for Higher Returns: While investing in small businesses can be riskier than established companies, it also offers higher returns. If the business succeeds and grows substantially, your initial investment can multiply several times.

- Flexibility and Control: Small business investors often have more flexibility and control over their investments compared to investing in publicly traded companies. You may have a say in business decisions, which can be appealing to those who want to be actively involved in shaping the company’s direction.

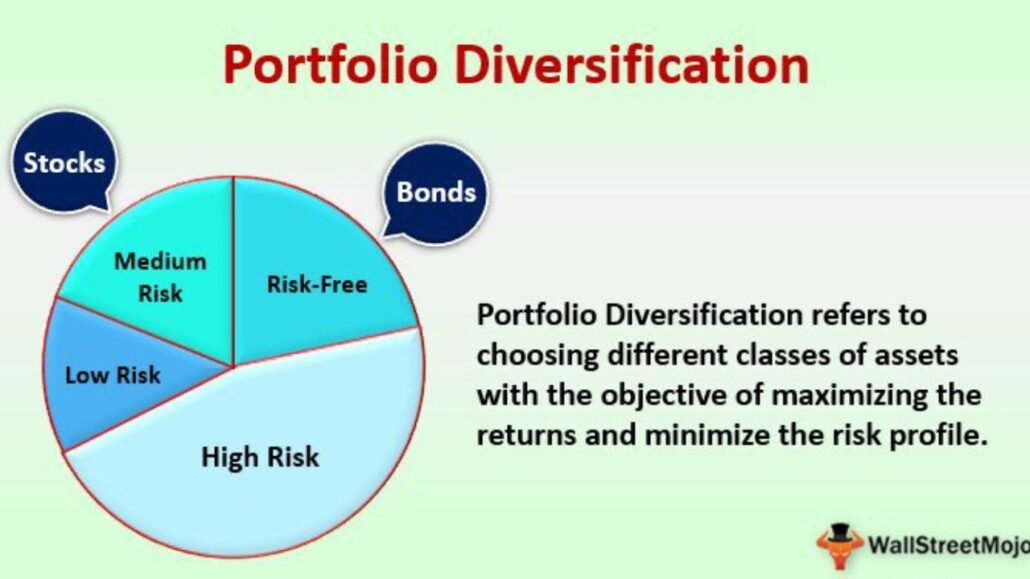

- Diversification: Your investment portfolio can be diversified by distributing risk among several asset classes through investments in small enterprises. This diversification can mitigate potential losses from other investments and enhance portfolio performance.

- Tax Benefits: Depending on your location and the structure of your investment, tax incentives or benefits may be associated with investing in small businesses. These could include deductions, credits, or preferential tax treatment for certain types of investments.

- Supporting Innovation and Entrepreneurship: By investing in small businesses, you’re supporting innovation and entrepreneurship, which are vital drivers of economic growth. Small businesses are often at the forefront of developing new products, services, and technologies, contributing to societal progress.

- Personal Fulfillment: Investing in a small business can be personally fulfilling, especially if you believe in the company’s mission or vision. It allows you to align your financial goals with your values and actively contribute to the success of a venture you’re passionate about.

- Networking Opportunities: Investing in small businesses can provide valuable networking opportunities. Connect with other investors, entrepreneurs, industry experts, and potential business partners, expanding your professional network and opening doors to future opportunities.

- Legacy Building: For some investors, investing in small businesses is a way to leave a lasting legacy. Supporting and nurturing a small business from its early stages can create a meaningful impact beyond financial returns, leaving a legacy of growth, innovation, and success.

Economic Impact

Job Creation

One of the most significant benefits of investing in small businesses is its contribution to job creation. Small businesses are known for adapting quickly to market demands, leading to increased hiring and reduced unemployment rates.

Local Economic Growth

Investments in small businesses stimulate local economic growth. As these businesses thrive, they generate income circulating within the community, further supporting other local establishments.

Potential for High Returns

Low Investment Risks

Small businesses often carry lower investment risks than large corporations. Their agility allows them to pivot quickly, mitigating potential losses and providing investors with a more stable investment environment.

Profit Potential

While the risks may be lower, the profit potential of investing in small businesses can be substantial. Many successful entrepreneurs started with small businesses that eventually grew into lucrative ventures.

Diversification of Investment Portfolio

Spreading Risks

Investing in small businesses allows for portfolio diversification. This strategy helps spread risks, ensuring that successes in others minimize the impact of a downturn in one sector.

Balancing a Portfolio

Small business investments balance a portfolio that larger, more stable investments may dominate. This equilibrium can enhance overall portfolio performance.

Support for Local Communities

Strengthening Local Economies

Investing in small businesses strengthens local economies by keeping money circulating within the community. This contributes to the creation of vibrant and sustainable local business ecosystems.

Community Engagement

Small business investments promote community engagement. Investors actively participate in the growth of local businesses, fostering a sense of community and shared responsibility.

Flexibility and Adaptability

Agility in Decision-Making

Small businesses possess the advantage of agility in decision-making. Their adaptability allows them to adjust to fluctuations in the market promptly. Making them resilient in dynamic economic environments.

Quick Response to Market Changes

Unlike larger corporations, small businesses can swiftly respond to market changes. This ability to pivot ensures they remain competitive and adaptable to evolving consumer preferences.

Ownership and Control

Active Involvement

Investors in small businesses often enjoy a more active role in the company’s operations. This level of involvement allows direct participation in decision-making processes, fostering a closer connection between investors and businesses.

Decision-Making Power

Small business investors typically have more significant decision-making power. This influence can empower investors who wish to play a more hands-on role in the direction and strategy of the business.

Tax Benefits

Small Business Tax Deductions

Benefits of Investing in a Small Business, Investors in small businesses may benefit from various tax deductions. These deductions can include expenses related to the investment, potentially reducing the investor’s overall tax burden.

Incentives for Investors

Governments often provide incentives for investing in small businesses, such as tax credits or exemptions. These incentives aim to encourage investment at the grassroots of the economy.

Social and Environmental Impact

Sustainable Practices

Many small businesses are committed to sustainable and ethical practices. Investors in such businesses contribute to environmentally friendly initiatives, aligning their investments with their values.

Social Responsibility

Investing in small businesses fosters social responsibility. Investors become integral to businesses, prioritizing ethical conduct, social impact, and community development.

Access to Innovation

Supporting Innovation

Small businesses are often hubs of innovation. Investing in these enterprises provides financial support for groundbreaking ideas, contributing to technological advancements and industry innovation.

Technological Advancements

Small businesses play a vital role in driving technological advancements in the digital age. For example, investors in small tech startups can be at the forefront of transformative innovations.

Personal Fulfillment

Contributing to Business Success

Investors in small businesses can find personal fulfillment in contributing to an enterprise’s success. Witnessing the growth and impact of a business they support can be immensely rewarding.

Sense of Accomplishment

The sense of accomplishment derived from nurturing a small business’s early stages can be profound. Investors become part of a journey, sharing in the triumphs and challenges of the businesses they support.

Exit Strategies

Selling a Profitable Business

Small businesses offer the potential for lucrative exits for investors seeking a return on their investment. Selling a profitable business can provide a substantial return on the initial investment.

Liquidation Options

Small businesses often provide various liquidation options for investors seeking to exit a business. These options can range from selling the business to liquidating assets.

Risks and Challenges

Market Uncertainties

While small businesses offer various benefits, they are not immune to market uncertainties. Investors must know the risks and challenges of the specific industry and market conditions.

Operational Challenges

Smaller enterprises may face operational challenges like resource constraints and intense competition. Investors should conduct thorough due diligence to mitigate these challenges.

Steps to Invest in a Small Business

Research and Due Diligence

Thorough research and due diligence are essential before investing in a small business. Investors should understand the market, the business model, and the potential risks.

Seeking Professional Advice

Consulting with financial advisors and business experts can provide valuable insights. Expert guidance can assist investors in navigating the complexity of small business investing and making well-informed selections.

7 Benefits of Investing in a Small Business

1. High Growth Potential

Small businesses are often agile and adaptable, allowing them to respond to market changes swiftly. This agility translates into higher growth potential than larger, more bureaucratic counterparts. Investing in a small business at its early stages can result in substantial returns as it navigates the path to success.

2. Direct Impact on Local Economy

Supporting small businesses means contributing to the growth of local economies. These enterprises play a pivotal role in job creation, fostering a sense of community, and keeping wealth circulating within the region. Investors become catalysts for positive change, influencing the economic landscape on a grassroots level.

3. Innovation Hub

Small businesses are breeding grounds for innovation. With limited bureaucracy and focusing on niche markets, these enterprises can quickly experiment and implement novel ideas. Investors aligning themselves with small businesses often find themselves at the forefront of groundbreaking innovations, reaping the rewards of being early adopters.

4. Personalized Investment Strategies

Unlike large corporations, small businesses often allow for more personalized and direct investment strategies. Investors can actively engage with management, understand the business intricacies, and tailor their support to specific needs. This level of involvement fosters a sense of partnership and increases the likelihood of shared success.

5. Diversification of Investment Portfolio

Including small businesses in an investment portfolio provides diversification, a key principle in risk management. Diversifying across different sectors, including small and medium enterprises, helps spread risk and insulates the overall portfolio from the impact of sector-specific downturns.

6. Tax Benefits for Investors

Governments worldwide recognize the importance of small businesses in driving economic growth. Consequently, many jurisdictions offer tax incentives for investors engaging with small enterprises. These incentives range from deductions on capital gains to tax credits, enhancing the overall attractiveness of investing in this sector.

7. Adaptive Marketing Strategies

Smaller businesses often excel at building close relationships with their customer base. Investing in such enterprises allows one to capitalize on adaptive marketing strategies that resonate with consumers. This personalized approach can increase brand loyalty and a more stable customer foundation.

Conclusion

Investing in a small business offers many benefits, from economic impact and diversification to personal fulfillment and social responsibility. Small businesses are the lifeblood of communities, and supporting them through investments is a meaningful way to contribute to both local economies and one’s portfolio.

FAQ

What are the Advantages of Investing in SMEs?

Investing in SMEs benefits the individual investor and contributes to economic growth and job creation. SMEs are the backbone of many economies, accounting for a significant share of employment and GDP. By supporting the development of these businesses, Limited Partners can positively impact the broader economy.

Why Do People Invest in Small Companies?

Growth potential: Compared to large-cap corporations, these smaller businesses have greater room to grow. This implies that investors in them could earn handsomely. Reduced share price: Small-cap stocks typically have a lower share price, facilitating your first investment.

What are the Benefits of Investors in Business?

Benefits of Investing in a Small Business, Investors contribute more to the table than just cash. They can also provide their extensive network and years of commercial experience. Your connection with them as an investor may also give you access to their manufacturer, distributor, vendor, advertising, and consumer contacts.

Why is it Important to Invest in Your Business?

Your business is yours and should remain that way, but if you invest in it enough, you could retain ownership as time goes on. Investing in your business allows your retention and private equity funds or venture capitalists often demand a say in how you run your business.