Marketing long-term care insurance in the current active insurance industry requires a strategic approach adapted to consumers’ changing needs. Let’s examine the approaches different kinds of insurance companies take to promote long-term care insurance.

Definition of Long-Term Care Insurance

Long-Term Care Insurance is a specialized form of coverage designed to address the financial implications of extended medical care and support services for individuals facing chronic illnesses or disabilities.

This insurance goes beyond typical healthcare plans, offering assistance with activities of daily living, such as bathing, dressing, and eating, which may become challenging due to age or health conditions.

Essentially, Long-Term Care Insurance provides a safety net for policyholders, ensuring they receive the necessary support and services without depleting their savings.

It serves as a crucial component in comprehensive financial planning, offering peace of mind and security for individuals anticipating potential long-term care needs in the future.

Importance of Marketing for Insurance Companies

It is impossible to overestimate the importance of marketing to insurance firms. In a sector where risk management and financial security are central to operations, efficient marketing is essential to connecting with and attracting prospective policyholders.

Insurance firms leverage strategic marketing initiatives to develop their brand, foster trust, and highlight the benefits of their products. Marketing helps customers learn about the value of different insurance products, such as property, health, and life insurance.

In addition, it facilitates insurers’ ability to adjust to changing market trends, establish connections with various demographics, and ultimately guarantee that people are well-informed when making crucial decisions regarding their insurance requirements.

Marketing’s significance is its capacity to close the communication gap between the public and insurers.

Types of Insurance Companies

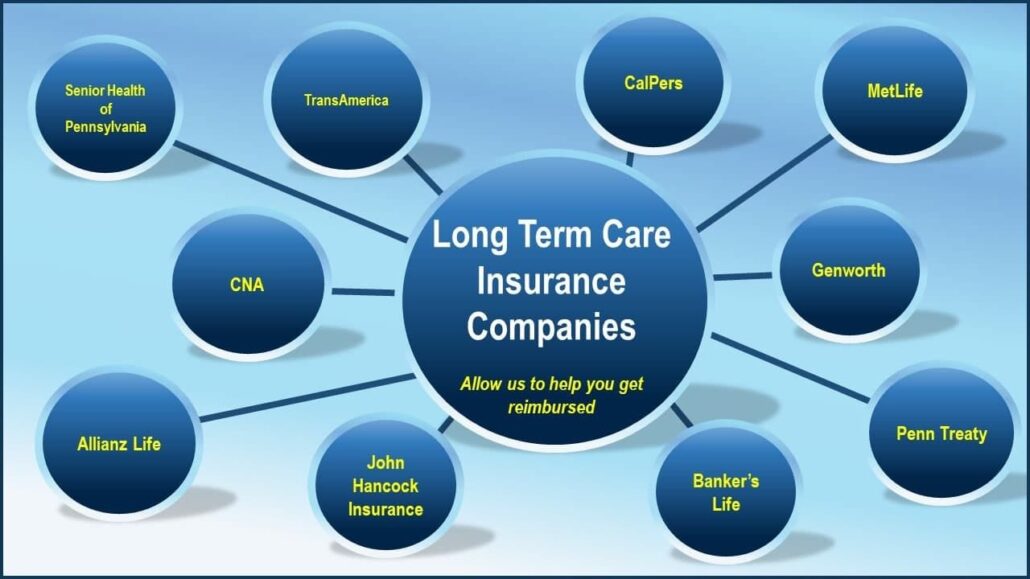

In insurance, various entities cater to diverse needs, each distinct in their approach. With their comprehensive portfolios, traditional insurance companies provide a broad spectrum of coverage, including long-term care insurance.

Specialized long-term care insurance providers carve a niche by exclusively focusing on this specific domain, tailoring policies to meet unique requirements.

Hybrid insurance policies, blending aspects of long-term care coverage with other forms, offer a versatile solution appealing to a wider audience.

This diversity ensures that consumers have options, ranging from comprehensive coverage to specialized plans, enhancing accessibility and addressing the evolving demands in the insurance landscape.

Traditional Insurance Companies

Traditional insurance companies play a pivotal role in long-term care coverage, offering a comprehensive approach to financial security.

These insurers seamlessly integrate long-term care insurance into their extensive portfolios, providing policyholders with a broad spectrum of coverage options.

Building a robust brand presence and cultivating a positive reputation is paramount for traditional insurers.

Leveraging digital platforms for online visibility and engaging in strategic collaborations with healthcare providers or senior living communities enhance their appeal.

As stalwarts in the insurance industry, traditional companies employ multifaceted marketing strategies, ensuring that potential policyholders recognize the importance of long-term care insurance within their overall financial planning.

Specialized Long-Term Care Insurance Providers

Which-types-of-insurance-companies-marketing, Specialized providers stand out as dedicated experts, finely tuning their services to cater to the distinct needs of individuals.

These insurers focus exclusively on crafting policies that comprehensively address the challenges of extended healthcare.

By targeting specific demographics, they ensure a laser-sharp approach, offering nuanced coverage that aligns with the varied requirements of their clientele.

Emphasizing education and customer-centricity, specialized long-term care insurance providers create a niche where policyholders can find tailored solutions, fostering trust and assurance in securing a future marked by financial stability and well-being.

Hybrid Insurance Policies

Hybrid insurance policies, a versatile solution in the insurance landscape, seamlessly combine long-term care coverage elements with other insurance forms.

These policies offer a unique blend of benefits, catering to a diverse audience seeking comprehensive protection.

Unlike traditional standalone long-term care insurance, hybrid policies provide policyholders with added flexibility and versatility.

They serve as a financial safety net by covering potential long-term care needs and offering benefits such as life insurance or return of premiums.

This innovative approach addresses the evolving needs of consumers, making hybrid insurance policies a compelling option in the realm of insurance solutions.

Marketing Strategies for Traditional Insurance Companies

Traditional insurance companies employ robust marketing strategies to establish a strong foothold in the competitive insurance market. Focused on brand building, they prioritize developing a positive reputation to gain the trust of potential policyholders.

Embracing the digital age, these companies leverage online platforms and employ digital marketing tactics to expand their reach and engage with a broader audience.

Collaborations and partnerships with healthcare providers or senior living communities enhance their perceived value.

By implementing strategic marketing initiatives, traditional insurance companies effectively communicate the importance of long-term care coverage, ensuring their offerings resonate with diverse demographics and meet the evolving needs of consumers.

Branding and Reputation Building

Establishing a robust brand and cultivating a positive reputation are pivotal elements in the insurance industry. Creating a distinctive brand identity establishes trust and recognition among potential policyholders.

A strong brand communicates reliability, professionalism, and a commitment to customer satisfaction.

On the other hand, reputation building involves consistently delivering on promises, providing excellent service, and actively engaging with customers.

In the competitive landscape of insurance, a reputable brand attracts new clients and fosters loyalty and trust, essential for long-term success.

It’s a dynamic process that requires strategic communication, ethical practices, and a genuine commitment to meeting customer expectations.

Online Presence and Digital Marketing

In the dynamic landscape of the digital age, establishing a robust online presence is paramount for businesses looking to thrive.

Digital marketing, a powerful tool in this endeavour, encompasses a range of strategies to enhance visibility and engagement.

Crafting a compelling online presence involves having an informative website and utilizing various digital channels strategically.

From social media platforms to search engine optimization (SEO) techniques, businesses can leverage these tools to connect with their target audience.

The ever-evolving nature of the online sphere requires staying updated on trends, utilizing analytics, and fostering meaningful interactions.

Online presence and digital marketing are integral components for businesses aiming to succeed in the modern marketplace.

Collaborations and Partnerships

Forging strategic collaborations and partnerships is pivotal in long-term care insurance marketing. These alliances can significantly enhance the reach and impact of insurance companies.

By teaming up with healthcare providers or senior living communities, insurers can establish a more comprehensive network that resonates with potential policyholders.

These collaborations bolster the credibility of insurance offerings and create a synergy that addresses the evolving needs of individuals requiring long-term care coverage.

In the dynamic landscape of healthcare and insurance, partnerships play a crucial role in fostering trust and expanding the scope of long-term care insurance accessibility.

Specialized Long-Term Care Insurance Providers

Which-types-of-insurance-companies-marketing, Planning for long-term care can feel overwhelming, but navigating the field with expert guidance makes all the difference. Enter specialized long-term care insurance providers – your map through the intricacies of coverage and claims.

Unlike traditional insurers, these dedicated players go beyond the basics, crafting personalized plans and offering invaluable support every step of the way.

Niche Targeting

Niche targeting plays a pivotal role in long-term care insurance marketing. This strategy involves tailoring marketing efforts to cater to defined demographic segments, ensuring a more personalized approach.

For long-term care insurance providers, identifying and understanding distinct groups’ unique needs and preferences allows for creating targeted campaigns.

By honing in on specific demographics, such as age brackets or health considerations, insurers can craft messages that resonate more deeply with potential policyholders.

This nuanced approach enhances engagement and increases the likelihood of individuals recognizing the relevance of long-term care insurance to their particular life circumstances.

In the competitive landscape of insurance marketing, niche targeting emerges as a powerful tool to connect with audiences more intimately, fostering trust and facilitating informed decision-making.

Educational Campaigns

Educational campaigns are pivotal in shaping informed decisions about long-term care insurance. These initiatives go beyond traditional marketing, aiming to enlighten potential policyholders on the nuances of long-term care coverage.

By offering clear explanations of policy details, sharing real-life case studies, and providing relatable content, educational campaigns create a comprehensive understanding of the importance of long-term care insurance.

These efforts extend to targeted niches, ensuring tailored information for diverse demographics. Leveraging technology, such as online tools and AI-driven content, educational initiatives strive to simplify complex information.

Ultimately, these campaigns foster a well-informed consumer base, empowering individuals to navigate the landscape of long-term care insurance confidently.

Customer-Centric Approaches

Adopting customer-centric approaches is pivotal in long-term care insurance marketing. These strategies prioritize potential policyholders’ unique needs and preferences, fostering trust and loyalty.

By tailoring policies to individual requirements and providing personalized service, insurers can create a more engaging and positive customer experience.

Customer-centric approaches also involve actively seeking and incorporating feedback, ensuring that the insurance offerings align closely with the evolving expectations of the target demographic.

Ultimately, placing the customer at the forefront of marketing initiatives strengthens relationships and enhances the overall effectiveness of long-term care insurance campaigns.

Hybrid Insurance Policies

Combine the safety net of life insurance with the peace of mind of long-term care in one flexible package.

Hybrid insurance policies offer a death benefit for your loved ones and financial support if you ever need long-term care, eliminating the “use-it-or-lose-it” worry. It’s two essential covers in one, providing security for your present and future.

Overview of Hybrid Policies

Delving into the realm of hybrid insurance policies reveals a dynamic landscape combining the best long-term care coverage with other insurance types.

These versatile policies offer a holistic approach, catering to a diverse audience seeking comprehensive protection. Understanding the nuances of hybrid policies is key to making informed decisions about one’s financial security.

This section will explore hybrid insurance’s intricacies, advantages, and potential drawbacks, providing a clear overview to guide individuals in safeguarding their future.

Advantages and Disadvantages

In weighing the pros and cons of long-term care insurance, it’s essential to consider the advantages and disadvantages. On the positive side, this insurance provides financial security and peace of mind for future healthcare needs.

However, potential drawbacks include premium costs and the possibility of never needing the coverage. Understanding these factors empowers individuals to make informed decisions regarding their long-term care insurance.

Tailored Marketing Approaches

Crafting personalized marketing strategies is essential for insurance companies offering long-term care coverage. Tailored approaches involve understanding the unique needs and preferences of potential policyholders.

By customizing messages, these companies can effectively communicate long-term care insurance benefits, creating a connection that resonates with diverse demographics.

This individualized approach enhances the coverage’s relevance and builds trust, fostering stronger relationships between insurers and their clients.

The Role of Technology in Long-Term Care Insurance Marketing

Which-types-of-insurance-companies-marketing, This phrase delves into the transformative interplay between technology and marketing in long-term care insurance.

It hints at how innovative tools, analytics, and strategies are breaking down barriers, personalizing outreach, and engaging potential customers in previously unimaginable ways.

It’s a glimpse into a future where marketing caters to individual needs, demystifies complex products, and ultimately makes securing long-term care a streamlined and informed decision.

Artificial Intelligence and Predictive Analytics

Artificial Intelligence (AI) and Predictive Analytics have revolutionized various industries by harnessing advanced technologies to analyze data patterns and make informed predictions.

AI algorithms process vast amounts of information, enabling businesses to gain valuable insights, make strategic decisions, and enhance efficiency.

The integration of these cutting-edge technologies continues to reshape the landscape of data-driven decision-making, providing organizations with a powerful tool to navigate complex challenges and capitalize on emerging opportunities.

Online Quote Calculators

Experience the convenience of online quote calculators when exploring long-term care insurance. These user-friendly tools simplify the complex task of estimating insurance needs.

By inputting basic information, individuals can swiftly obtain personalized quotes, empowering them to make informed decisions about their financial security. Dive into the future of insurance planning with the ease and precision offered by online quote calculators.

Customer Relationship Management (CRM) Systems

CRM or Customer Relationship Management systems are pivotal in modern business operations.

These robust tools streamline customer interactions, enhance communication, and provide valuable insights.

From managing leads to improving customer satisfaction, CRM systems are essential for businesses aiming to build lasting relationships with their clientele.

Efficient implementation of CRM systems contributes to increased efficiency and a deeper understanding of customer needs and preferences.

FAQ

What is the Meaning of Long-Term Insurance?

Which Types of Insurance Companies Marketing Long-Term Care Insurance, What is long-term insurance coverage? This protects in a life-altering event such as a death, retirement, or disability. Over an extended period, you would pay a monthly payment to a long-term insurance provider.

What are The Top 5 Health Insurance Companies?

UnitedHealth Group, Anthem, Kaiser Permanente, Centene, and Humana are the top five health insurance providers in revenue. They account for over half of the market share in the health insurance sector overall.

What is The Difference Between Life Insurance and Long-Term Insurance?

Which Types of Insurance Companies Marketing Long-Term Care Insurance, On the one hand, life insurance policies offer guaranteed maturity benefits, customizable premium periods, flexible income payout possibilities, and lifetime coverage—all at an increased premium cost. Conversely, a term plan is a pure life insurance that provides solely a death benefit at a relatively low cost and within an affordable premium range.

How Long is a Term in Term Insurance?

The simplest and purest type of life insurance is a term life insurance policy: If you pass away within the specified time frame, your family (or anyone else you choose as your beneficiary) will receive a cash payout from the premiums you pay for a set period, usually between 10 and 30 years.

Is Insurance Long-Term or Short-Term?

Which Types of Insurance Companies Marketing Long-Term Care Insurance, Term insurance is typically called “short-term” since it offers reasonably priced coverage for a set amount of time, such as ten or thirty years. Additionally, short-term life insurance lasts for a year or less. In contrast, “long-term” typically refers to permanent life insurance that lasts for the entirety of the policyholder’s lifetime.