Commercial Insurance Marketing Strategies in Colorado Springs CO, As businesses in Colorado Springs, CO, strive for growth and stability, navigating the complexities of the commercial insurance landscape becomes crucial. Commercial insurance plays a pivotal role in safeguarding businesses against unforeseen risks, from protecting assets to ensuring liability coverage. However, in a competitive market like Colorado Springs, effective marketing strategies are essential for insurance providers to reach their target audience and establish a strong presence.

Overview Of Commercial Insurance Marketing

Commercial insurance marketing encompasses various strategies for promoting insurance products and services tailored to businesses’ needs. The demand for comprehensive insurance coverage remains constant in a rapidly evolving market like Colorado Springs, where industries ranging from technology to hospitality thrive. Therefore, understanding the dynamics of commercial insurance marketing is paramount for insurers to stay ahead of the competition.

Learning The Commercial Insurance Market in Colorado Springs, CO

Colorado Springs is a hub of diverse business ventures in Colorado’s vibrant landscape, accommodating a spectrum of enterprises ranging from fledgling startups to established corporations across various sectors.

The city’s economic tapestry, woven intricately with threads of geographical nuances, prevailing industry trends, and the ebb and flow of economic tides, intricately shapes the demand for commercial insurance products.

In this dynamic milieu, characterized by the ever-looming specters of cybersecurity breaches and the capricious whims of natural disasters, businesses in Colorado Springs are increasingly inclined towards insurance solutions that offer holistic coverage, safeguarding their interests amidst the unpredictable terrain of risks.

Challenges And Opportunities

The commercial insurance market in Colorado Springs offers promising prospects for insurers, yet it also brings forth distinct hurdles. Insurers must grasp local businesses’ specific requirements and challenges to craft impactful marketing approaches.

Moreover, keeping pace with regulatory shifts and market dynamics empowers insurers to adjust and seize new openings as they arise swiftly.

By staying attuned to the evolving landscape and tailoring strategies to meet Colorado Springs’ unique demands, insurers can position themselves for success despite both opportunities and challenges.

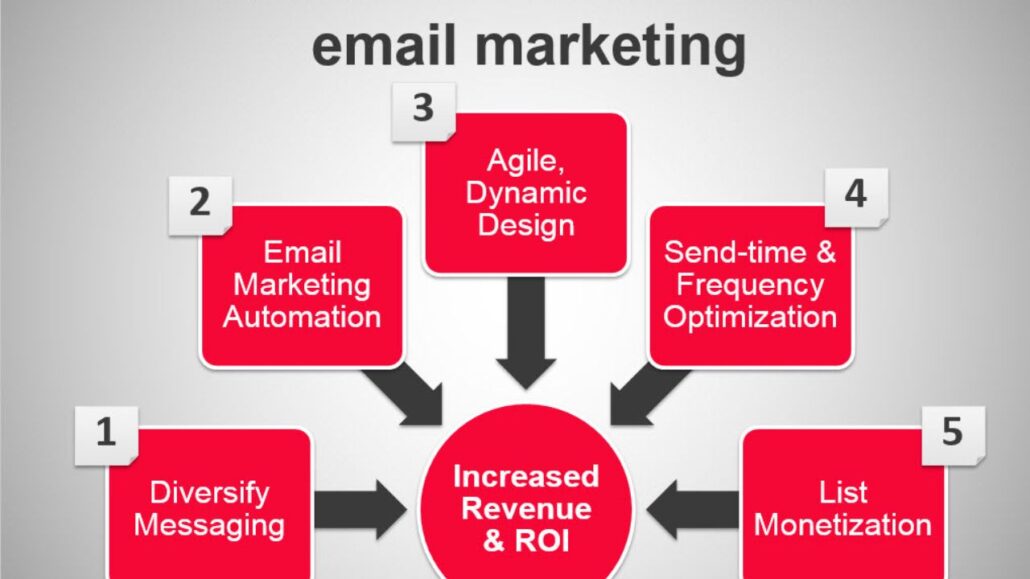

Effective Strategies For Commercial Insurance Marketing

Utilizing technology and harnessing data-driven insights are pivotal in efficiently reaching the intended audience.

Insurance providers can elevate their marketing endeavors substantially by tapping into the power of social media platforms for targeted advertising and integrating customer relationship management (CRM) systems for personalized communication.

Additionally, establishing strategic collaborations with local businesses and industry associations cultivates trust and credibility within the community. These initiatives not only enhance insurers’ visibility but also strengthen their relationships with stakeholders, ultimately contributing to their overall success in the market.

Tailoring Insurance Products To Local Needs

Every sector operating within Colorado Springs presents its distinct array of risks and hurdles. As a result, insurance firms are compelled to furnish bespoke solutions precisely aligned with enterprises’ requirements.

Whether the focus lies on furnishing specialized coverage tailored to the intricacies of healthcare facilities or proffering risk mitigation strategies catered to construction firms, a profound comprehension of industry intricacies emerges as indispensable.

Such insight ensures the delivery of tailored services and underscores the commitment to providing substantial value to clientele.

Networking And Community Engagement

Establishing connections within the local business community plays a pivotal role in the effectiveness of commercial insurance marketing. This involves participating in networking events, sponsoring industry conferences, and engaging in community outreach initiatives.

These efforts not only increase brand visibility but also cultivate enduring partnerships. Through proactive involvement with stakeholders, insurance companies can glean valuable insights into prevailing market trends and customers’ evolving preferences.

In essence, active engagement with the local business ecosystem serves as a conduit for building trust, fostering collaboration, and staying attuned to the market’s ever-changing needs.

Leveraging Technology For Marketing

Cutting-edge technologies like artificial intelligence (AI) and big data analytics are transforming how insurers promote their offerings. Employing AI algorithms for predictive analytics and integrating user-friendly mobile apps enable insurers to improve customer satisfaction and simplify policy management procedures.

Additionally, embracing digitalization empowers insurers to adapt swiftly and remain responsive amidst evolving market conditions. These technological advancements not only enhance operational efficiency but also contribute to delivering personalized services tailored to the needs of modern consumers.

By leveraging these innovations, insurers can stay ahead in a competitive landscape while meeting the dynamic demands of the market.

Customer-Centric Approach

In the face of intense competition, placing utmost importance on customer satisfaction becomes essential for insurance companies. Swiftly attending to client inquiries, ensuring seamless claims processing, and proactively offering risk management solutions showcase a dedication to superior service and a commitment to excellence.

Insurers can foster loyalty and set themselves apart in a bustling marketplace by cultivating robust relationships with customers.

This emphasis on meeting and exceeding client expectations is a cornerstone for building trust, enhancing reputation, and ultimately driving sustainable growth amidst stiff competition.

Measuring And Analyzing Marketing Efforts

Insurance companies need to monitor key performance indicators (KPIs) closely and assess the impact of their campaigns to enhance their marketing strategies.

This involves keeping a keen eye on website traffic, conversion rates, and social media engagement, utilizing sophisticated data analytics tools to gain meaningful insights into consumer behavior patterns.

By examining these metrics, insurers can pinpoint areas for improvement, enabling them to fine-tune their marketing approaches and allocate resources more efficiently.

In essence, leveraging data analytics facilitates a deeper understanding of customer preferences and empowers insurers to make informed decisions that drive their marketing efforts toward greater success.

Compliance And Regulation

Learning and adhering to the regulatory framework is essential for conducting business in the commercial insurance sector. Compliance with state and federal regulations is a foundation for transparency and fosters trust among clients.

Additionally, remaining abreast of industry standards and adopting best practices is imperative for insurance companies. By staying informed and proactive, insurers can effectively manage legal risks while positioning themselves competitively in the market.

This commitment to compliance not only safeguards clients’ interests but also strengthens the integrity of the insurance industry, promoting stability and reliability.

Continuous Learning And Adaptation

In the dynamic landscape of Colorado Springs’ market, embracing innovation and adaptability becomes paramount for maintaining a competitive edge. Insurers who prioritize ongoing training and professional development arm themselves with the essential knowledge and skills to cater to the ever-changing demands of their clientele.

Whether it involves exploring novel distribution channels or integrating emerging technologies into their operations, fostering a culture of perpetual learning is instrumental in cultivating resilience and fostering growth.

This commitment to staying abreast of industry advancements ensures relevance in a fast-paced environment and positions insurers to proactively address evolving customer expectations, thereby solidifying their position as industry leaders.

Cost-Effective Marketing Techniques

Smaller insurance companies operating with constrained budgets can achieve substantial outcomes through cost-efficient marketing. These strategies range from utilizing social media influencers to conducting informative webinars, showcasing innovative marketing approaches that amplify return on investment without stretching financial resources thin.

By strategically focusing on channels that promise robust audience engagement at minimal acquisition expenses, insurers can efficiently connect with their target demographic while adhering to budgetary limitations.

This prudent allocation of resources ensures effective outreach efforts without compromising financial stability, thus empowering smaller insurers to compete and thrive in their respective markets.

Building Trust And Credibility

In a field where trust serves as the cornerstone, forging a robust brand image stands as the linchpin for enduring triumph. The bedrock of this endeavor lies in fulfilling pledges, upholding obligations, and fostering transparency in every engagement.

Through such steadfast practices, insurance entities can cultivate a sense of trustworthiness and authenticity among their clientele. Moreover, actively soliciting input and tackling customer inquiries epitomize a dedication to perpetual enhancement and client contentment.

In essence, by adhering to these principles, insurers not only fortify their reputations but also fortify their bonds with those they serve, ensuring sustained success in the long haul.

Conclusion

Getting Around the commercial insurance market in Colorado Springs, CO, requires a strategic approach that combines innovation, customer-centricity, and a deep understanding of local dynamics. By implementing effective marketing strategies tailored to the needs of businesses, insurers can carve out a competitive edge and establish a strong presence in the market. From leveraging technology to fostering community engagement, the key lies in building meaningful connections and delivering value to clients.

FAQ

What Are The Common Types Of Commercial Insurance Coverage Needed In Colorado Springs?

Common types of commercial insurance coverage include general liability, property insurance, workers’ compensation, and commercial auto insurance, tailored to the specific needs of businesses in Colorado Springs.

How Can Small Businesses In Colorado Springs Benefit From Commercial Insurance Marketing?

Small businesses can benefit from commercial insurance marketing by accessing comprehensive coverage tailored to their unique risks, enhancing customer credibility, and safeguarding their assets against unforeseen liabilities.

What Role Does Community Engagement Play In Commercial Insurance Marketing?

Community engagement is crucial for building trust and credibility within the local business community. Insurers can strengthen their brand presence and foster long-term relationships with clients by participating in networking events, sponsoring industry initiatives, and supporting community causes.

How Can Insurers Measure The Success Of Their Marketing Efforts In Colorado Springs?

Commercial Insurance Marketing Strategies in Colorado Springs Co, through a variety of measures, including website traffic, conversion rates, social media engagement, and customer satisfaction surveys, insurers can assess the effectiveness of their marketing campaigns. Insurance companies can find areas for development and adjust their marketing strategy by examining these KPIs.

What Are Some Cost-Effective Marketing Techniques For Insurers Operating In Colorado Springs?

Commercial Insurance Marketing Strategies in Colorado Springs CO, Cost-effective marketing techniques for insurers include:

- Leveraging social media platforms for targeted advertising.

- Hosting educational webinars.

- Partnering with local businesses for cross-promotion.

- Utilizing search engine optimization (SEO) strategies to enhance online visibility.