To invest in tax liens in Texas, attend tax lien auctions held by county governments. Research properties, bid on liens, and pay the winning bid. Receive interest and potential ownership if taxes remain unpaid. Understand local laws and risks before investing.

You cannot buy tax liens in Texas; it’s a tax deed state, but why is the county selling redeemable deeds? They’re auctioning because they did not collect back taxes, and the county needs money.

Tax Liens

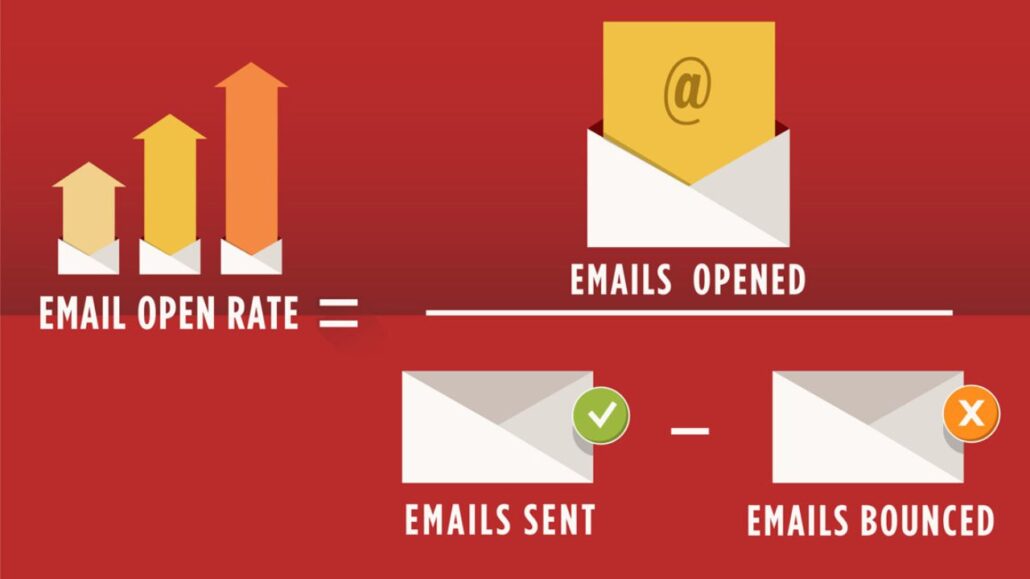

Before diving into the specifics of investing in tax liens in Texas, it’s crucial to grasp the concept of tax liens themselves. A tax lien is a legal claim against a property for unpaid property taxes. When property owners fail to pay their taxes, the government places a lien on the property, allowing them to collect the overdue taxes plus interest and penalties. Tax lien investing is imperative to grasp the complexities surrounding tax liens – legal assertions against properties for unpaid taxes – and their pivotal role in the investment landscape.

The Texas Advantage

Texas presents a particularly attractive landscape for tax lien investors. The state’s robust economy, booming real estate market, and favorable legal framework make it a prime destination for savvy investors seeking high returns.

The unparalleled advantages await investors in the Lone Star State. With its thriving economy, booming real estate market, and investor-friendly legal environment, Texas offers a unique opportunity for those seeking lucrative returns in tax lien investments.

The Process

Investing in tax liens in Texas follows a straightforward process. County governments auction off tax liens on properties with delinquent taxes, allowing investors to bid on them. Winning bidders purchase the liens, effectively becoming creditors to the property owner.

Participating in tax lien auctions in Texas involves navigating a structured process orchestrated by county governments. Investors engage in strategic bidding, securing liens on properties with delinquent taxes and positioning themselves as creditors to potential real estate assets. This auction process is fundamental to successful tax lien investing.

Due Diligence is Key

Thorough due diligence is essential before participating in a tax lien auction. Research the properties up for auction, assess their market value, and evaluate any potential risks associated with the investment. Conducting due diligence minimizes the likelihood of investing in properties with hidden issues or low potential for return.

It is paramount to thoroughly research properties before participating in tax lien auctions. Careful examination, known as due diligence, involves evaluating market values, assessing potential risks, and scrutinizing property details to make informed investment decisions.

Bidding Strategies

Success in tax lien investing often hinges on strategic bidding. Determine your investment criteria and set a maximum bid for each property based on its potential return on investment. Avoid getting caught up in bidding wars that could drive up the purchase price and diminish your profitability.

Optimal approaches to bidding can significantly influence the success of your tax lien investments. By carefully assessing each property’s potential return and setting appropriate maximum bids, investors can enhance their chances of securing profitable opportunities while avoiding overpaying in competitive auctions.

Securing Your Investment

Once you’ve successfully purchased a tax lien, it’s vital to protect your investment. Monitor the property for any developments, such as foreclosure proceedings or redemption by the owner. Stay informed about your rights as a lienholder and take appropriate action if necessary to safeguard your investment.

Protecting your investment is paramount in ensuring long-term profitability and stability. By staying vigilant and proactive, you can safeguard your financial interests and mitigate potential risks associated with tax lien investing in Texas.

Potential Risks

While tax lien investing offers lucrative opportunities, it also has risks. Properties with tax liens may have underlying issues such as structural damage, legal encumbrances, or environmental hazards. Additionally, the property owner may redeem the lien, resulting in lower-than-expected returns for the investor.

The inherent uncertainties involved in tax lien investing encompass the possibility of encountering properties with structural flaws, legal complexities, or environmental hazards. Additionally, investors face the risk of property owners redeeming liens, potentially impacting expected returns.

Some Points of Invest in Tax Liens in Texas

How to Invest in Tax Liens in Texas Online: Investing in tax liens in Texas online involves researching properties with delinquent taxes through county websites or specialized platforms. After identifying a suitable property, you can participate in tax lien auctions online, bidding on liens against properties with unpaid taxes. Successful investors can earn interest or acquire properties if taxes remain unpaid.

Tax Delinquent Properties for Sale List Texas: Texas provides lists of tax delinquent properties available for sale through county auctions. These lists typically include details like property address, assessed value, outstanding tax amount, and auction dates. Investors use these lists to identify potential opportunities for tax lien investments or acquiring properties.

Where to Buy Tax Lien Certificates: Tax lien certificates can be purchased at county auctions, which are often held online or in person. Investors bid on certificates representing the right to collect delinquent property taxes. Various websites and platforms also facilitate tax lien certificate purchases, providing access to auctions across different states.

Tax Lien Investing for Beginners: Tax lien investing for beginners involves understanding the process of acquiring liens on properties with overdue taxes. Beginners should research state-specific regulations, evaluate investment risks, and learn about potential returns. Online resources, books, and workshops can help beginners navigate tax lien investing.

Tax Lien Investing Pros and Cons: Pros of tax lien investing include relatively predictable returns, potential property acquisition at a discount, and secured investment. Cons may include the possibility of redemption by property owners, legal complexities, and competition at auctions. Evaluating pros and cons helps investors make informed decisions.

How to Buy Tax Deeds in Texas: Purchasing tax deeds in Texas involves participating in county auctions where properties with unpaid taxes are auctioned to recover tax debts. Investors bid on properties, and successful bidders receive ownership rights. Detailed knowledge of county procedures and legal requirements is essential.

Tax Lien Certificates for Sale: Tax lien certificates are available for sale through county auctions and online platforms. These certificates represent a lien on a property for unpaid taxes. Investors can purchase these certificates to earn interest or acquire properties if taxes remain unpaid.

Tax Lien States: Tax lien states are jurisdictions where local governments sell tax liens on properties with delinquent taxes to recover revenue. States vary in their tax lien systems, including redemption periods, interest rates, and auction procedures. Understanding which states operate under tax lien systems is crucial for investors.

Conclusion

Investing in tax liens in Texas can be a rewarding venture for investors seeking alternative avenues for generating income. By understanding the process, conducting thorough due diligence, and employing strategic bidding strategies, investors can capitalize on this lucrative opportunity while minimizing risks. With the right approach and diligence, tax lien investing in Texas can yield substantial returns and contribute to a diversified investment portfolio.

FAQ

How does tax lien investing work in Texas?

Tax lien investing in Texas involves purchasing delinquent property tax liens at auction. Investors pay the overdue taxes on properties, gaining a lien on the property. If the owner doesn’t pay within a redemption period, the investor can foreclose and gain ownership or earn interest.

Can you buy a house by paying the back taxes in Texas?

Yes, in Texas, you can purchase a house by paying off its back taxes. Through a process called a tax sale, the property is auctioned, and the winning bidder assumes ownership by paying the outstanding taxes and any associated fees.

What is the best state to buy tax lien certificates?

How to Invest in Tax Liens in Texas, Choosing the best state for tax lien certificates depends on factors like interest rates, redemption periods, and competition. States like Florida, Arizona, and Colorado are often favored for their favorable laws and potential returns, but research is crucial for informed decision-making.

What is the difference between a tax lien and a tax deed in Texas?

In Texas, a tax lien is a legal claim against the property for unpaid taxes, giving the government the right to seize it if taxes remain unpaid. A tax deed, however, is the actual document transferring ownership of property sold at a tax sale due to delinquent taxes.

Are tax liens legal in Texas?

Yes, tax liens are legal in Texas. When property owners fail to pay property taxes, the government can place a lien on the property to secure the unpaid taxes. This allows the government to eventually foreclose on the property if the taxes remain unpaid.

How long do Texas state tax liens last?

In Texas, state tax liens last for 10 years from the date they’re filed unless they’re extended by court order. After expiration, the lien is automatically removed from public records. Liens can negatively impact credit and property ownership until resolved.